With the American election, prediction markets like Polymarket and BET on Drift have seen unprecedented volume. While the concept of prediction markets is not new, their shift to blockchain brings enhanced transparency and access. As these markets evolve, decentralized oracles are poised to play a growing role in verifying outcomes and ensuring data reliability—an increasingly crucial factor as the space matures. Frag up.

What are Prediction Markets?

Prediction markets are platforms where participants bet on the outcomes of future events like elections and financial trends. They offer a unique and transparent insight into public sentiment and interests. In decentralized prediction markets, smart contracts manage bets on a blockchain, allowing global access and minimizing interference. These markets reveal “skin-in-the-game” sentiment, as participants commit actual stakes to their predictions. These user-driven markets can be an invaluable real-time metric of where opinions lie.

Decentralized prediction markets have great potential and various possible applications. One of the key ideas behind them is the wisdom of the crowd—the idea that predictions made by a diverse group of people are often more accurate than those made by a small group of experts or biased surveys. This approach can lead to better, more reliable outcomes. Plus, because participants have financial stakes in the markets, they’re incentivized to do their research, which can improve the quality of predictions even further. These markets also offer real-time insights into public opinion, which could be really useful in situations like elections, helping voters, campaigns, and policymakers get a clearer sense of what’s actually happening in the moment.

While prediction markets may also provide valuable data, they should be viewed as just one of several tools in gauging sentiment. Intangible factors like hype and bandwagoning can occasionally reflect skewed views and may sometimes act as a self-fulfilling prophecy by reinforcing popular expectations. Overall, prediction markets can serve as a way to understanding market sentiment.

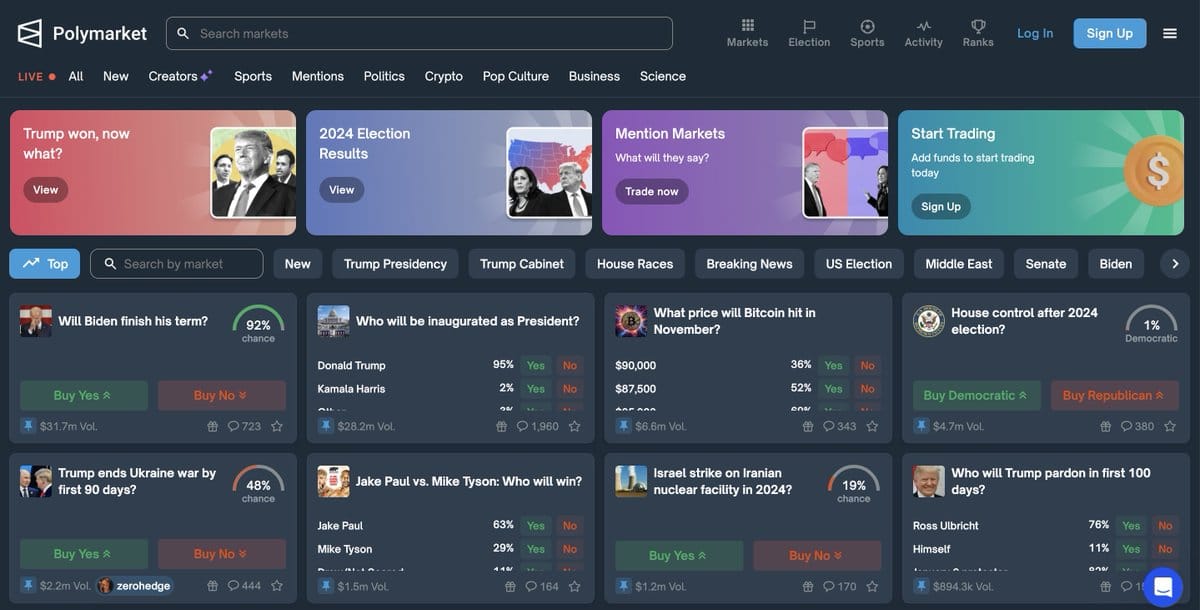

Polymarket and Bet on Drift: Popular Decentralized Prediction Markets

Polymarket is the leading decentralized prediction market platform, attracting attention from even mainstream audiences and non-crypto media. This popularity is further backed by substantial funding, including a recent $70 million investment led by prominent figures like pro-Trump billionaire Peter Thiel and Ethereum co-founder Vitalik Buterin. Notably, during the recent American elections, Polymarket saw a surge in network volume and user growth. Not only did the 2024 Presidential Election bring in a volume of $700 million, but other events like the 2024 Champions League Winner and the 2025 Super Bowl Champion created volumes of $100 million, $20 million respectively. The high metrics reflect the broad appeal and traction of Polymarket’s markets among diverse audiences.

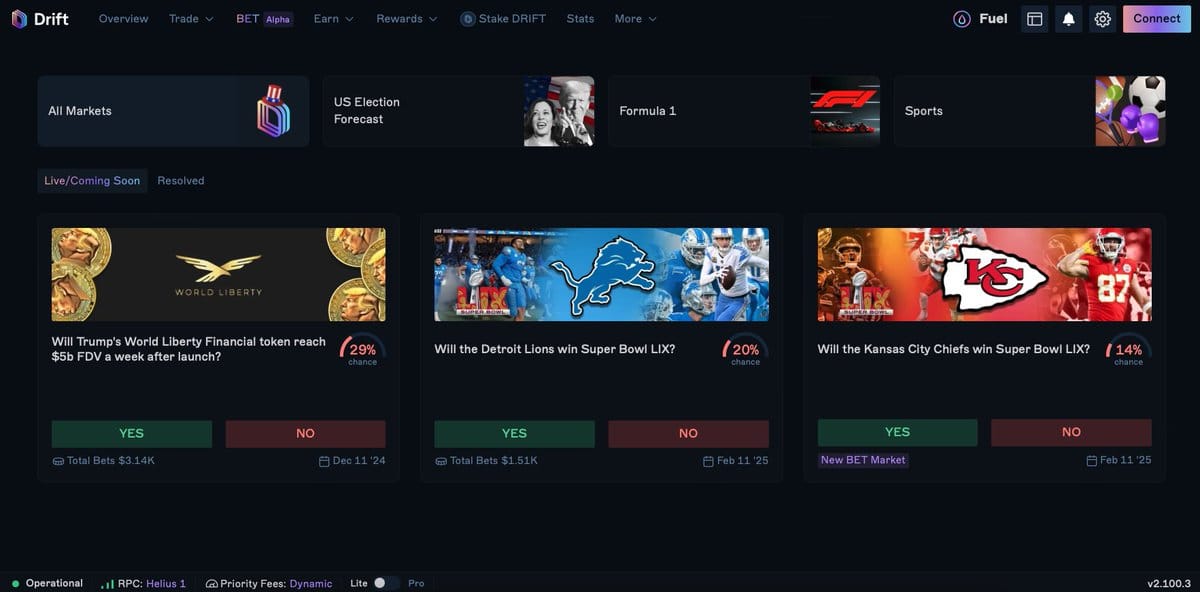

BET on Drift is the first capital-efficient prediction market on Solana, and it introduces unique features that set it apart from other platforms. Leveraging Drift’s borrow/lend capabilities, BET allows users to earn yield on trades automatically. Also, the platform enables “structured bets,” allowing users to hedge by going long on a prediction while shorting assets like Bitcoin, all within a unified ecosystem. Users can also bet on events using a wide range of tokens other than just USDC. With these options, BET aims to become a key player, offering a more incentivized approach to prediction markets by integrating yield generation and diversified asset support in one platform.

What Happens Once the Event is Over?

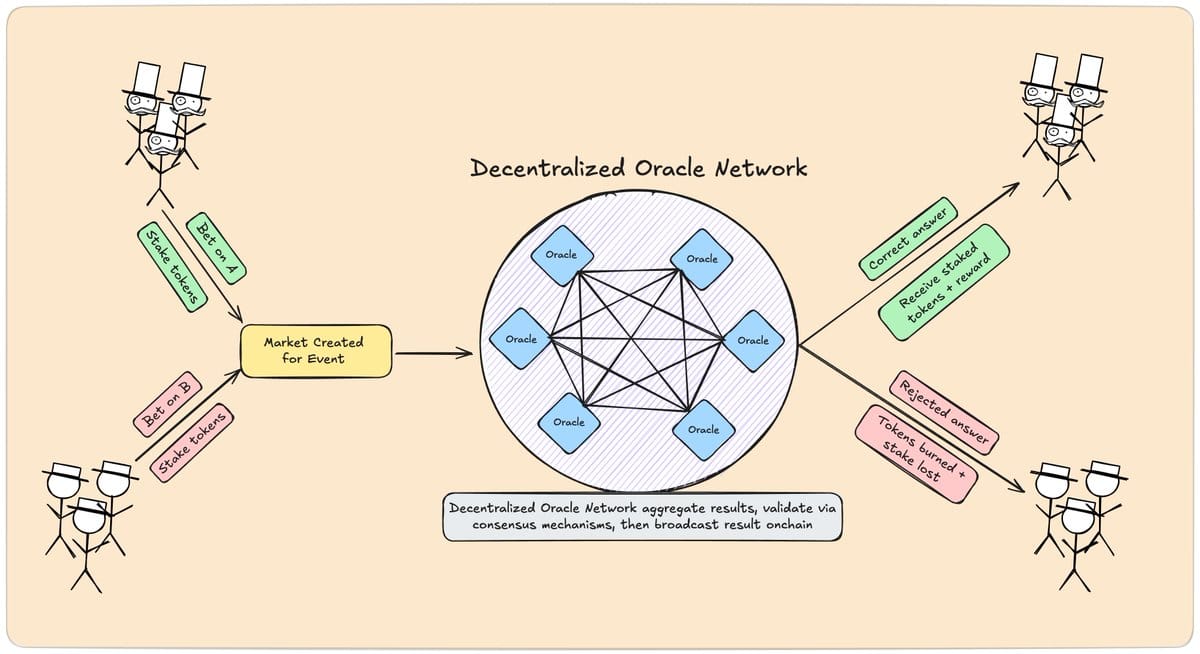

In prediction markets, once the event is over, accurate and timely event verification is essential to distribute payoffs correctly. This is where oracles step in. Oracles serve as intermediaries that bring external, real-world data onto the blockchain, allowing smart contracts to verify outcomes and settle markets. For quantitative events, like those based on price feeds, oracles can quickly provide up-to-date data. However, for non-quantitative events (e.g., the outcome of a sports game or election), decentralized oracle networks are implemented, with decentralized consensus mechanisms or human input from trusted reporters to determine results.

Decentralized oracles involve a network of oracles that first aggregate data, validate it through consensus mechanisms like PoS, and then deliver the data onto a smart contract. Similar to blockchain networks, this process helps reduce the risk of centralization and single points of failure. Even if some nodes provide incorrect data, the consensus mechanism can filter it out, ensuring that only verified data reaches the blockchain.

Security in Oracle Networks via Restaking

Restaking protocols play a vital role in bootstrapping and securing oracle networks, especially when decentralized consensus mechanisms are used to validate events. By restaking LSTs from large, secure networks like Solana and Ethereum, oracle networks inherit trust and reliability. This inherited economic security is essential to maintain reliable data flow, which is critical for settling high-stakes prediction markets.

One example of oracles and restaking platforms working together is Switchboard and Jito Restaking. Switchboard is one of the leading oracle networks in Solana, and on early August 2024, Switchboard announced that they will be leveraging Jito Jito (Re)staking's multi-tiered slashing and customizable staking parameters to enhance their economic security and improve the performance of their data feeds, helping to secure Solana DeFi.

Proud to announce that Switchboard plans to be the FIRST protocol to support the @jito_sol (Re)staking platform 🤝

— Switchboard 🔌 (@switchboardxyz) August 8, 2024

What does it mean?

Let's get into details 👇 pic.twitter.com/ponfHcjc5b

The Future of Prediction Markets, in the Perspective of LRTs

Looking to the future, as decentralized prediction markets continue to grow and capture real-world news and market data onchain, the role of oracle networks in providing timely and reliable information will only become more crucial. Restaking protocols, such as those provided by Jito, Solayer, and supported by Fragmetric, are positioned to strengthen oracle networks, ensuring that prediction market users can count on secure, fair settlements and confidently claim their winnings. With these advancements, decentralized prediction markets will remain an engaging and trustworthy avenue for gauging global sentiment.

Join the Fragmetric Community

- Website : fragmetric.xyz

- Read through the documentation : docs.fragmetric.xyz

- Meet the community in Discord : discord.gg/fragmetric

- Follow @fragmetric on X : x.com/fragmetric

About Fragmetric:

Fragmetric is a native liquid restaking protocol on Solana that aims to improve the economic potential and security of the Solana ecosystem. Fragmetric succeeded in carrying out NCN reward distribution by utilizing Solana's token extension. Additionally, Fragmetric created useful solutions, such as the Normalized Token Program, for utilizing various LSTs in restaking platforms. The goal of Fragmetric is to create a safe, open, and incredibly effective restaking system that empowers users and supports the stability of the Solana restaking ecosystem.

Go back

Go back