Introduction

"If you don't find a way to make money while you sleep, you will work until you die." This famous Warren Buffett remark emphasizes the importance of generating passive income. The discovery of how to earn money passively—without lifting a finger—is sometimes revolutionary for the majority of us who are still trying to survive. One of the most common ways to generate passive income is to lend money to others, who will then pay interest over time. This strategy puts your money to work for you while you are asleep.

However, direct participation in all of this is inconvenient. Finding dependable borrowers, having adequate funds to lend, and collecting interest repayments all pose significant challenges. Financial institutions, such as banks, make things easier. When the bank divides the interest generated, minus fees, with you. Placing your money in an online bank, such as UFB Direct, would result in an annual fluctuating interest rate of around 5%. Higher-yielding alternatives become more appealing when compared to a typical bank, such as Bank of America or Chase, which pays an interest rate of 0.01%.

But what if there were assets other than traditional currencies that you could earn revenue simply by holding? Enter Solana Staking. You would stake your Solana tokens ($SOL) on a service like Sanctum to earn up to 8.5% interest. For the bullish Solana, simply holding on to your $SOL may seem like a squandered opportunity, especially given Buffett's suggestion.

While this is similar to the revenue earned in traditional banking, it differs in that it is generated through a completely different mechanism unique to blockchain technology. The profits come from using the staked $SOL to help secure the Solana network. You will receive extra $SOL in exchange for helping to improve the network's security and efficiency. This new way of earning is only possible through the cryptocurrency ecosystem. Unlike a bank deposit, where only one entity, the depositor, has access to the cash, the money can be liquid and free to use while generating incentives. This is the new world of financial liberty—no more waiting in long queues at the bank. That being said, let us examine how staking works on Solana and what makes it so appealing for making your money work for you.

What is PoS (Proof of Stake)?

Blockchain technology underlies cryptocurrency networks, within which lots of participants keep one singular, shared state. These are called validators, all racing to update the state of the network concerning new transactions. However, prior to finalizing that new state, the participants must reach an agreement in order to guarantee its integrity. There are two significant consensus mechanisms in this regard: Bitcoin uses Proof of Work, and Solana uses Proof of Stake.

| Proof of Work | Proof of Stake | |

|---|---|---|

| To Change the State | solving complex computational puzzles to add changes in the shared state. | Transactions are validated based on the number of coins held and the willingness to'stake' for network security. |

| Network | Bitcoin, Ethereum Classic | Solana, Ethereum |

Solana is another decentralized cryptocurrency network that runs on its native token, $SOL. In the Proof of Stake consensus algorithm, the validators have stakes in the network. For Solana, this stake is in the form of $SOL. It does not have the characteristics of PoW and thus does not require validators to solve complex puzzles to arrive at an update in blockchain status. Validators compete in that respect by leveraging their holdings of $SOL to update the shared state. A validator's chances of winning the election to update the blockchain's state and receive the block rewards increase with the amount of Sol they stake.

The PoS mechanism in Solana isn't just a process for the validation of transactions; rather, it's also about network security. Validators who are successful in updating the state are incentivized to continue working on securing the network with more SOL. Those who will try to do this in a malicious way face penalties through a process called slashing. Only in this way can validators guarantee the network's best behavior, protecting and upholding its integrity.

Solana's POS can be thought of as economically rooted. The price of SOL is directly linked to the security of the Solana network. In most cases, when $SOL has a high price, it has higher incentives for validators to act honestly, making it a more secure network. But if $SOL were to drop rapidly, as was witnessed during the Terra-Luna collapse, then the security of the network could be in jeopardy. This could subtract value from staked tokens and reduce validator incentives to maintain the integrity of the network in such cases.

This mechanism of PoS extends beyond simple blockchain maintenance. Validators are responsible for sustaining the broader Solana ecosystem; the health of this ecosystem is intrinsically linked to the value of their staked SOL. To put it another way, teams such as Solana Compass, Galaxy, Coinbase, Helius, Sanctum, Jupiter, and Jito do not just act as validators to Solana but build on this ecosystem in a way that ensures it grows and is stable. Their efforts ensure that the value of $SOL—and, by extension, the security of the Solana network—is strong.

How PoS works in Solana (1)

Solana's PoS system is built on the Byzantine Fault Tolerance algorithm, which extends contributions by requiring users to provide a stake as collateral to the system. Solana’s PoS allows any user who does not want to host their own validator nodes (computer servers that participate in network validation) to delegate their $SOL holdings to a validator of their choosing. This will return to the user a share of the benefits captured as a result of the validator's actions. Thus, this delegation mechanism exists to allow SOL holders to indirectly contribute to the network's security while getting staking rewards.

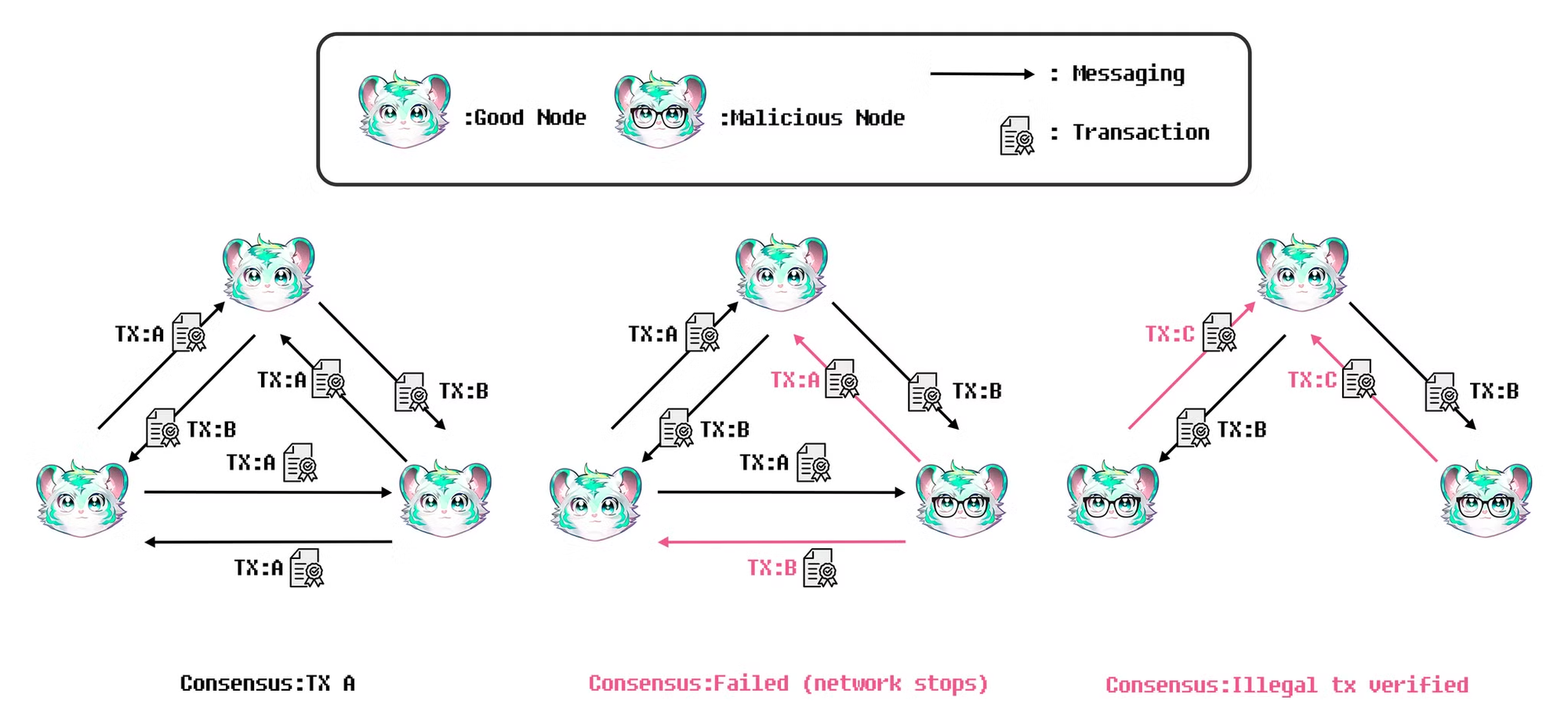

The PoS system in Solana is paired with BFT-based algorithms known as tower-BFT. This is a BFT-based algorithm similar to Tendermint (Cosmos), MonadBFT (Monad), and Narwhal/Tusk (Sui). These algorithms are crucial to the security of a network because they assure its integrity at specified thresholds. The 1/3 rule, for example, states that if more than one-third of the network's nodes are dishonest, the network will come to a halt. Super minority refers to a group that owns 33% of Solana's network stake. At the time of writing, Solana has around 1,500 validators. Only 18 of those hold 33% of the total share, allowing them to command a super minority. Some of the validators listed above are Galaxy, Helius, Coinbase, Ledger, Figment, P2P.org, Everstake, Staking Facilities, Jito, Twinstake, and Kraken. This concentration of stake among a few validators poses a risk to the entire network. It is consequently critical that a significant number of independent and highly staked validators enter the chain in order to decrease the power of the Super Minority. Another crucial threshold is the 2/3 rule, which states that if hostile nodes control more than two-thirds of the network, they can collude to approve any transaction, including illegal ones. In this instance, the network would no longer perform properly.

In general, the wider the network, the more secure it is, because it is far more difficult for a single entity to corrupt enough nodes to reach critical thresholds. In most circumstances, this increase in exchange for security results in a loss of efficiency because more data must be sent, potentially slowing the process of establishing consensus. There is always a trade-off; so, Solana must strike a balance between scaling and retaining the required speed and efficiency in her proof-of-stake system. In the next chapter, we'll look at how Solana solved this trade-off.

How PoS Works in Solana (2)

Solana's PoS system achieves worldwide shared state agreement by combining a Tower BFT algorithm with Proof of History. This process is at the heart of how the Solana network achieves incredible throughput with minimal latency.

PoH functions as a cryptographic clock, allowing the Solana network's validators to agree on time and event sequence without requiring direct contact. This enables Solana to generate blocks in synchrony, rather than waiting for consensus to be reached before moving on to the next block. It is integrated with Tower BFT, allowing Solana to skip slow or unresponsive slot leaders, ensuring that the network runs quickly and effectively.

Solana's consensus process is built on Tower BFT, which means it relies largely on vote transactions to maintain the blockchain's integrity and consistency. Transactions of this type are guaranteed not to be surpassed by other types of transactions when added to blocks. In practice, vote transactions account for the vast bulk of transactions in each given block on Solana.

Validators continuously vote for blocks as they are created, even when previous blocks are still being confirmed.

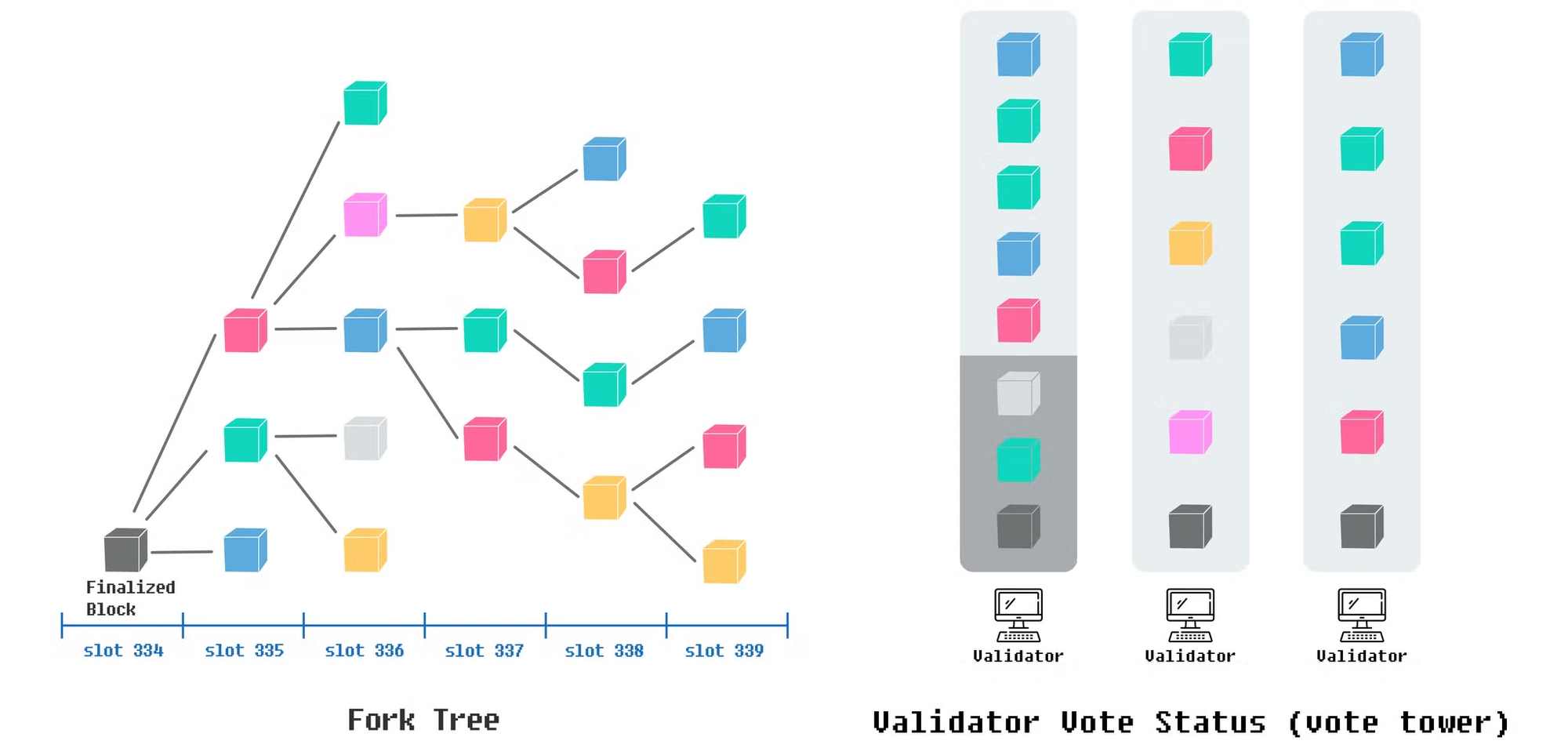

Each vote transaction is signed, and the validator verifies the vote by coupling the block hash with his public key. If a validator receives multiple of these blocks for the same slot, he keeps track of all possible forks until he identifies the "optimal" block. In other words, they are asynchronous local state transition functions that broadcast off-chain, cast votes on-chain, and maintain a "Vote Tower" structure in which sequential votes enhance the value of a fork.

The lockout periods from their earlier votes bind validators to this chosen fork, making reversing one's decision costly. While this lockout mechanism is not enforced at runtime, social consensus does; repeated infractions would result in slashing. Furthermore, the validators sign the hash of all parent blocks between their previous vote and the finished block to avoid the identification of duplicate blocks and, ultimately, vote disputes.

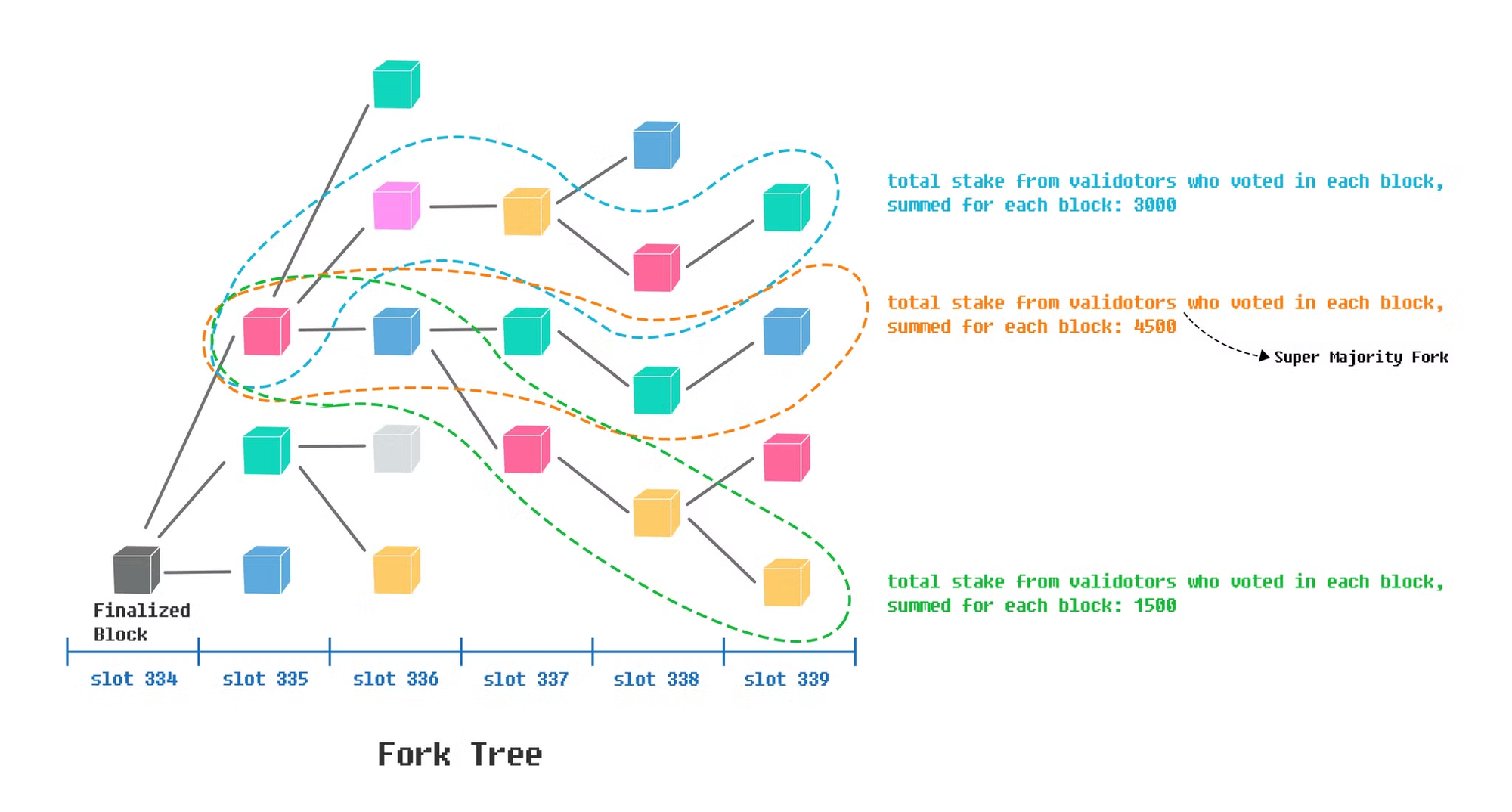

Solana employs two separate rule sets: one for short-term consensus and one for long-term consensus. This is similar to LMD Ghost and Casper FFG, designed on Ethereum; there it enables two levels of commitment, "Confirmed" and "Finalized" blocks. A "confirmed" block relies on votes out of at least two-thirds of validators, whereas a "finalized" block needs suceeding blocks for at least 32 onto it with a supermajority of votes. Fork-choice rules ensure that the network reaches consensus on the leading chain by adding or subtracting stakes according to votes and selecting the root with the heaviest weighted subtree as the optimal fork.

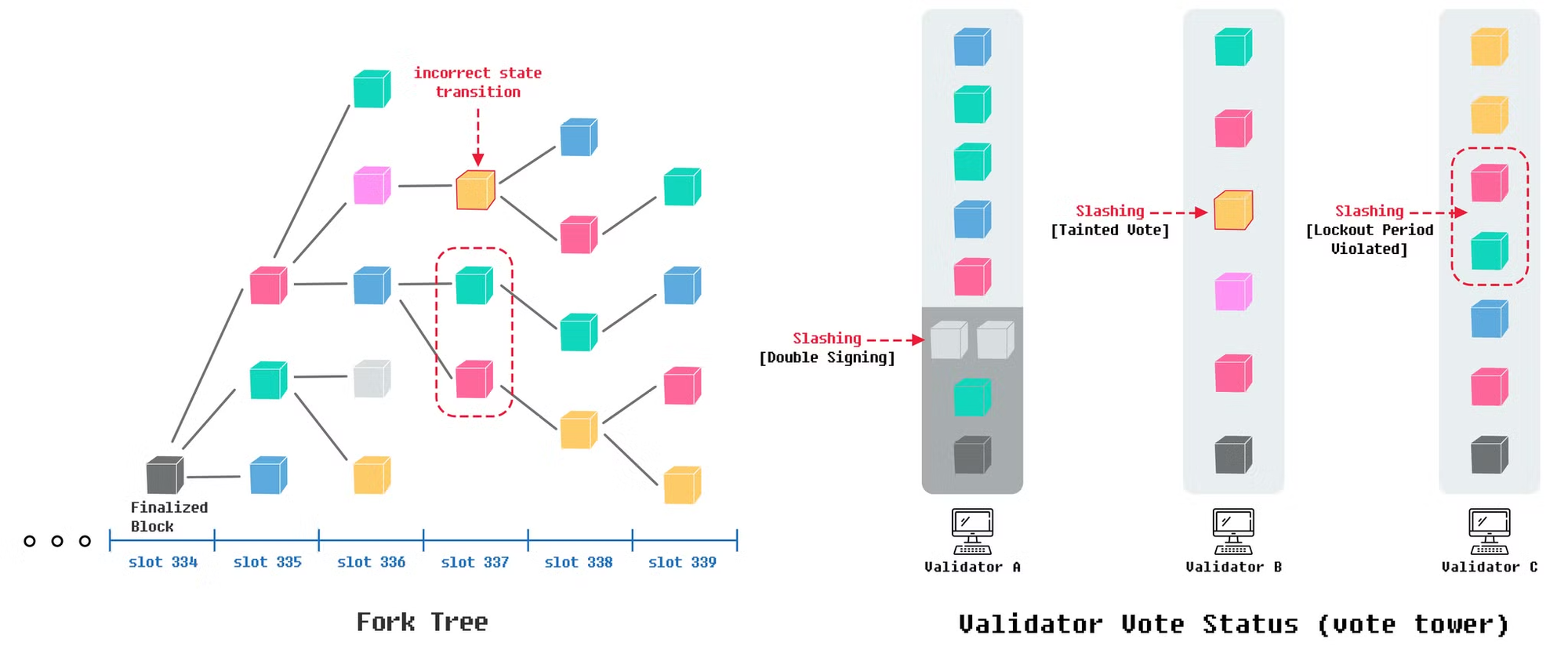

Slashing is one of the most important components in assuring the Solana network's safety and security, and it results directly from the PoS slashing process. Slashing would involve imposing economic penalties on validators in order to assure good intentions and protect a network from a variety of potential assaults.

The criteria under which this slashing can occur are numerous, and they are designed to avoid various types of misbehavior by a validator.

- Double Signing :Submitting multiple blocks at the same slot can confuse the network. The alarm for this detection would result in a reduction of the stake in that validator.

- Tainted Votes :Validators voted for valid blocks, showing the appropriate state transition design. If a validator votes for the incorrect state transition, he votes for an invalid block, which is regarded a corruption of the outcome. If he is caught, a part of his stake is deducted as a punishment, according to the rules.

- Lockout Period Violations :Validators must adhere to specific lockout periods; voting results will be regarded locked for a set period. Voting wrongly or too early after the lockout period can disrupt the network and cause slashing.

Slashing Procedures and their Effects :

The Solana network tracks each validator's misconduct and has a slashing mechanism in place when a validator begins to misbehave. Following verification, the validator's staked SOL can be reduced by a fraction or the entire amount. Following that, the slashed tokens can be transferred to the network's reward pool or burned, enhancing network security through financial disincentives. This will result in a significant pecuniary loss for the misbehaving validator, making it a strong deterrence to others. Slashing assures that the method guarantees the honesty and efficiency of validators, removing any uncertainty about Solana's status as a trusted and dependable source.

Current Situation and Plans for Slashing :

There is currently no automated slashing—or any other type of consequence for misbehaving. Overview Enforced through social consensus, with manually gathered execution following the need. However, in the future, Solana intends to use in-program slashing to secure automatic misbehavior detection with a penalty.

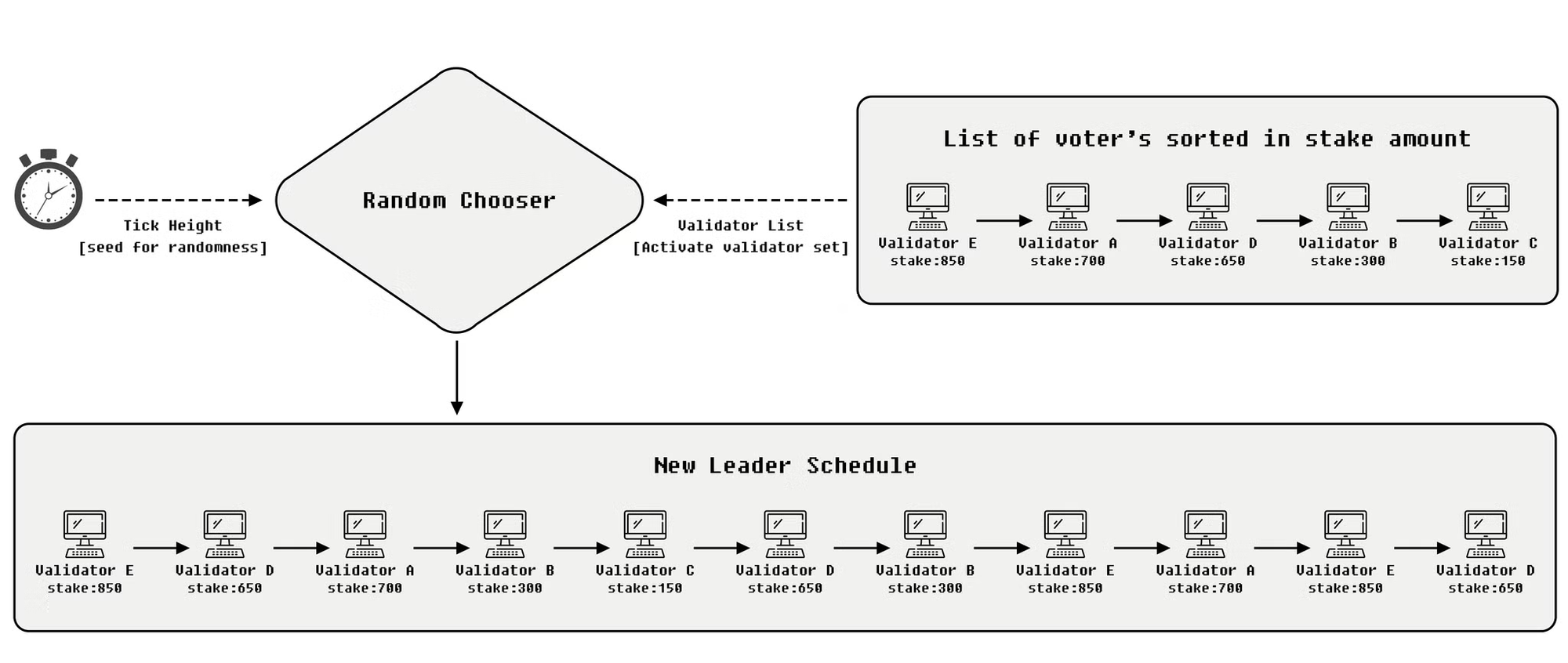

Leader scheduling is the process of determining which validator should be presented with a proposal for additional blocks. This is to sample all active validators and order them by the amount staked to SOL to form a stake-weighted set—these nodes are randomly selected for the a leader schedule. In exchange, this ensures an honest and transparent method of coining, allowing a block proposer to base their judgment on how much SOL each validator has staked.

To summarize, Solana's PoS system architecture consists of several critical components that power the network for security and efficiency.

- Tower BFT: A consensus method maintains the exact state of blockchain for each validator, ensuring network security through vote transactions and lockout time.

- Proof of History (PoH): A Rivers-like cryptographic clock that tracks time and synchronizes the network without requiring validators to communicate directly.

- Slashing Mechanism: This mechanism is in place to prevent malicious validators from harming the network.

- Leader Scheduling: Controls the order in which the various validators propose blocks, it is dependent on the random seed and stake-weighted sort.

All of this assures that Solana is completely secure and capable of supporting extremely high TPS

How Solana Staking Works (1)

Delegators and validators are the two primary stakeholders in the Solana network's security and performance. Understanding their functions and underlying mechanisms is critical to understanding how staking works inside the Solana ecosystem.

Solana participants in staking:

Delegators:

These are generic users with SOL tokens that they want to delegate for staking. They do not run validator nodes themselves, but instead outsource their SOL to a validator's node. In return, they secure the network and collect staking rewards. Delegators serve an important function in sustaining the network without getting involved in technical elements like validation.

Validators:

These are the actual node operators who run validator nodes. In this sense, validators confirm transactions, store a full replicated ledger (3-day amount), create new blocks, accept SOL delegations from delegators, and share staking rewards in response. All validators participate in consensus (voting on blocks), but are ultimately responsible for network integrity and security via the ledger relay. Both the delegators and the validators have the same incentives: they benefit when the network is operational and secure. Delegators are compensated for their stake, while validators receive a portion of these rewards as a commission for participating in the network on behalf of delegators. This creates an economic security layer by compensating delegators for the risk that their stake will be slashed if their chosen validator misbehaves.

As a result, the method incentivizes validators to do their jobs well because it affects their revenue and reputation.

Solana Staking System

Solana's on-chain staking mechanism is divided into two programs: stake program and vote program, which handle interactions among players like as delegators, validators, and the network itself.

- Vote Program: This caters to the validator's means of voting on blocks, as voting is extremely important for consensus finality. This ensures that validators who correctly vote for blocks receive appropriate network incentives. Furthermore, the Vote Program helps to facilitate slashing by penalizing malicious or irresponsible validators.

- Stake Program: It serves as a rewards manager, regulating the incentives provided to delegators and validators for their network participation. It also enables manual delegation; delegators can select a validator and delegate their SOLs to him.

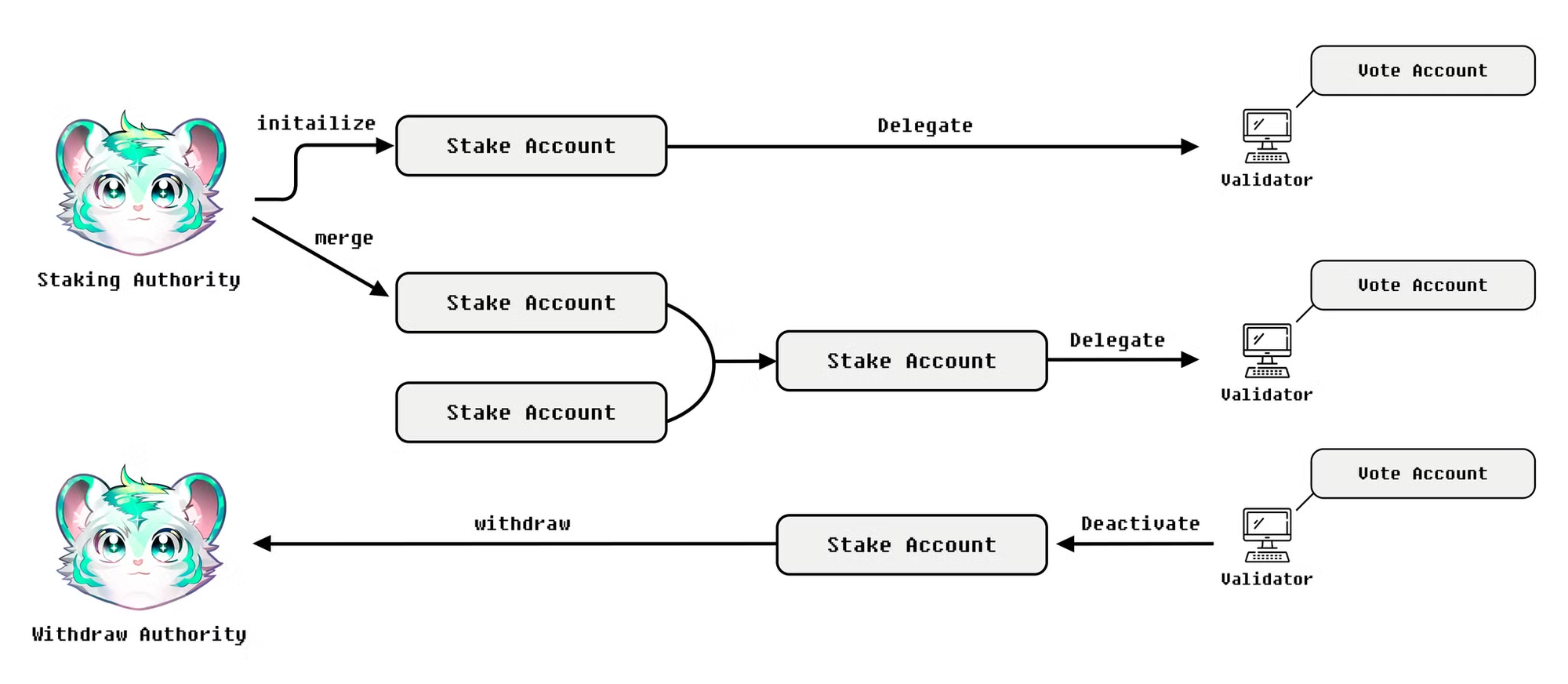

Under this system, stake accounts and vote accounts are at the center of regulation governing rewards and obligations.

- Stake Accounts: These are accounts controlled by each delegator and used to store staked SOL as well as track delegation details. A stake account can be in numerous states, including uninitialized, initialized, staked, or rewards pool. The "Stake" state provides information on the delegation, such as the validator to whom it is delegated, the amount of staked SOL, and the activation and deactivation epochs.

- Vote Accounts: Validators control these accounts, which record all of their votes for all blocks in the network. The account monitors the credits acquired based on the validator's voting history and maintains certain extra validator-related state. That includes the validator's public key, the authorized withdrawal amount, the commission rate, and recent votes. In the event of a successful and correct vote, the validators are awarded their well-deserved credits, which collect over the period. Following the period, validators can swap their collected credits for inflation rewards. The rewards are subsequently distributed to the delegators.

Stake Instructions

The Stake Program includes various guidelines for operating stake accounts:

- Split and Merge: The Split instruction allows delegators to split their stake across multiple accounts, giving them more flexibility in managing the staked SOL. Whereas the merge command is used to combine two stake accounts into one to simplify management.

- Lock: A stake account can be created with a fixed lockup, which determines when and how staked SOL can be withdrawn. A custodian can control this lockup by enforcing or bypassing lockup limitations based on predetermined conditions.

- Delegate, Deactivate, and Redelegate: The delegate command will be used to assign the whole balance of a stake account to a specific vote account. The deactivate command prevents a stake account from participating in the validation of transactions that it holds, thus unstaking the SOL. Redelegate: allows a delegator to deactivate his present stake and re-delegate without creating a new stake account.

There are two different types of authorities responsible for managing each stake account:

- Stake Authority: This authority covers staking signatures, delegation, deactivation, and merging or splitting stake accounts.

- Withdraw Authority: This authority manages the withdrawal of staked SOL from a staked account and can also create additional authorities for the account.

Finally, a custodian is assigned during account opening and has the authority to change lockup requirements if necessary.

Reward Calculation and Distribution

So, under Solana's staking scheme, validators do not have equal shares in reward calculations. The rewards for validators are based on block creation and transaction validation. Fundamentally, votes on valid transactions will be added together to determine a validator's total credit, which has a significant impact on the rewards that validator will receive at the end of the epoch. The rewards are subsequently dispersed to the delegators after the validator has taken their share.

This is a dynamic process that compensates validators who perform well and have more trustworthy voting histories, resulting in higher returns for their delegators. When properly motivated, holders of SOL would undoubtedly seek out validators with a proven track record.

In essence, the competitive ecosystem contributes to the Solana network's overall security and efficiency. Staking in Solana is essentially a sophisticated ecosystem in and of itself, with delegators and validators coexisting to support those who maintain the network.

Solana created these programs such that each party contributes positively to security and performance incentives. The balance it establishes goes a long way toward ensuring that the network remains as secure, effective, and decentralized as feasible, given the equilibrium that its features enforce.

How Solana Staking Works (2)

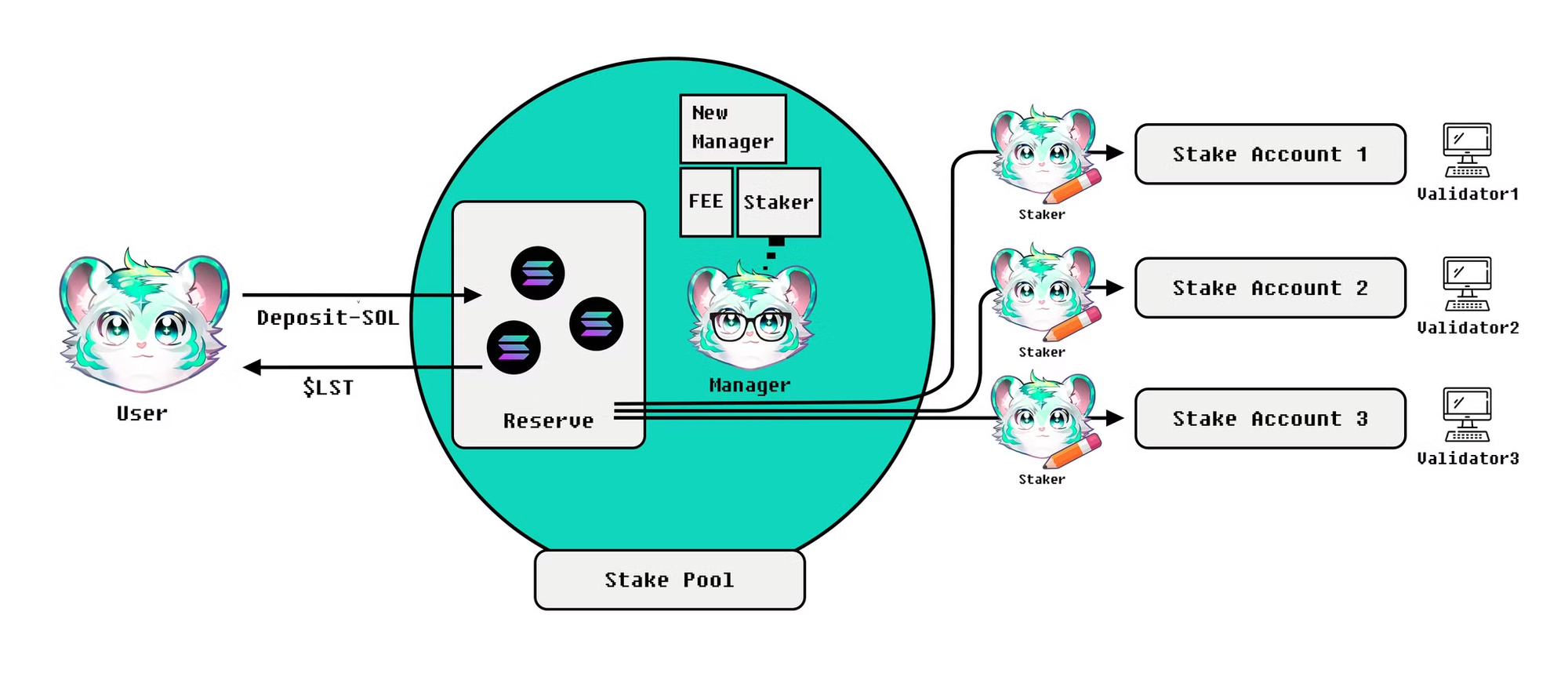

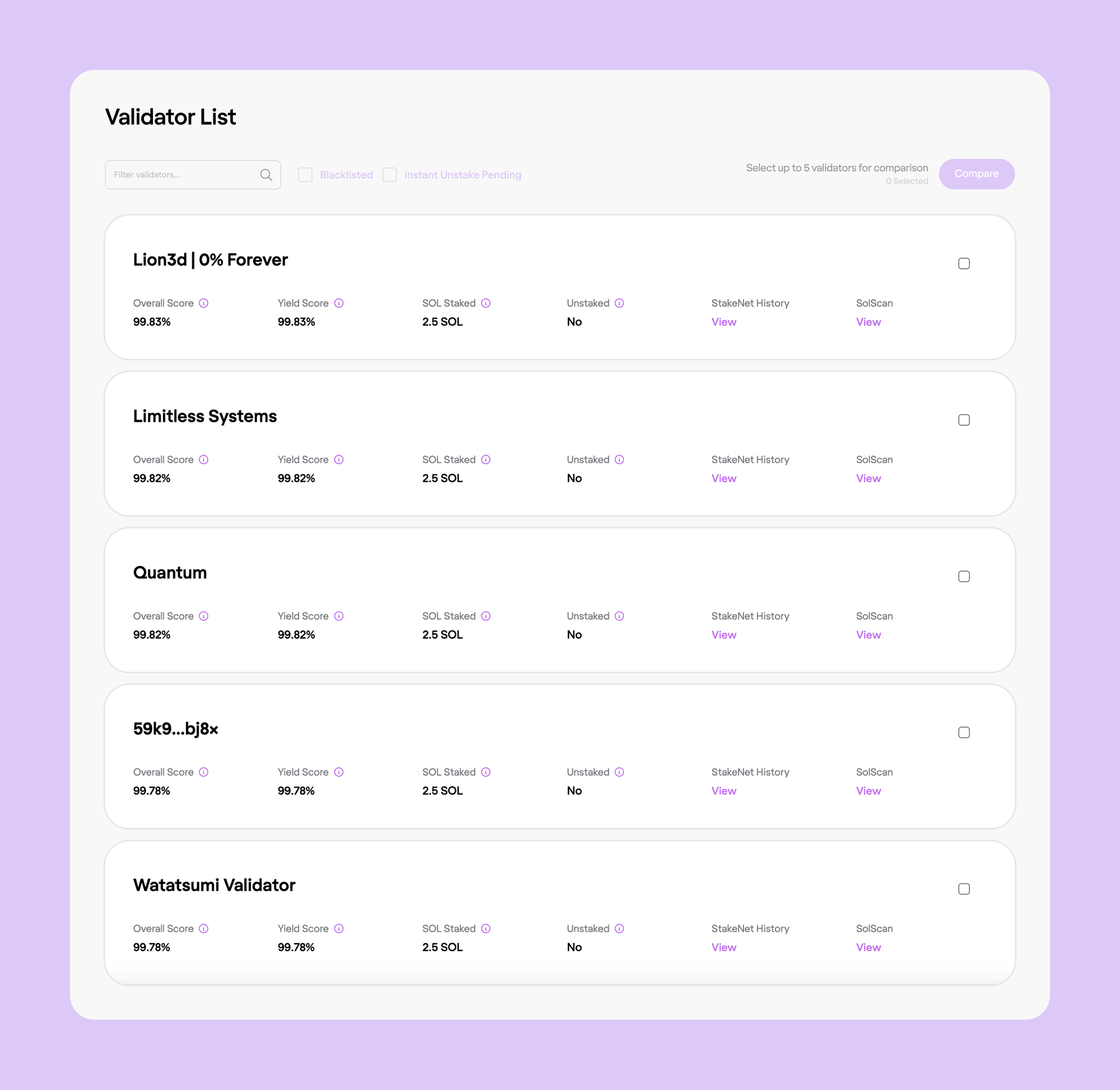

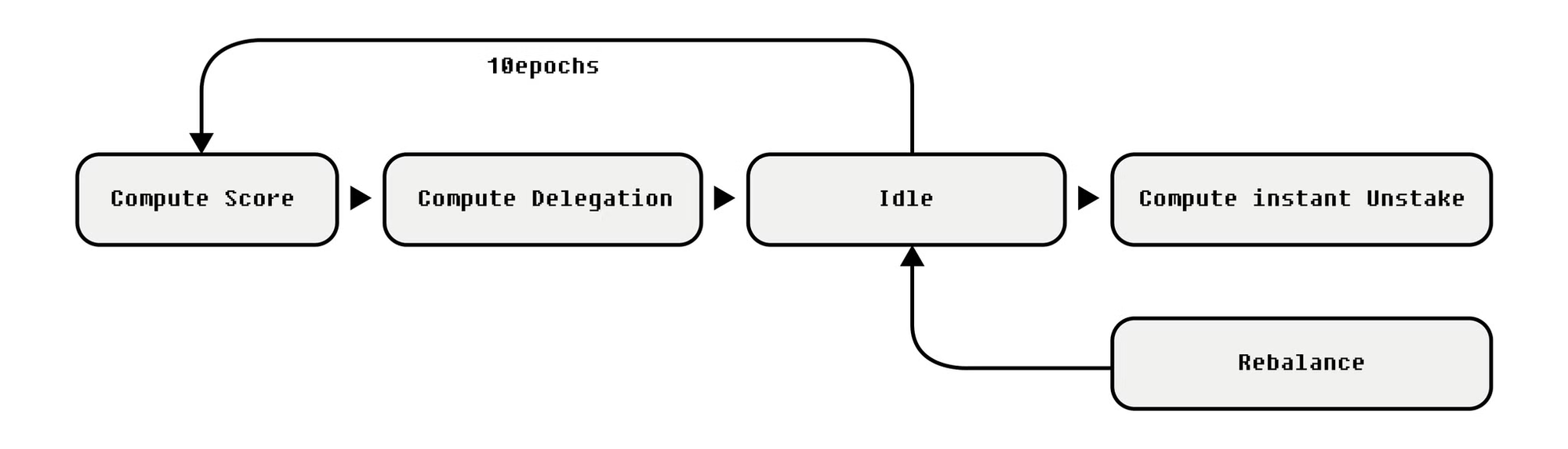

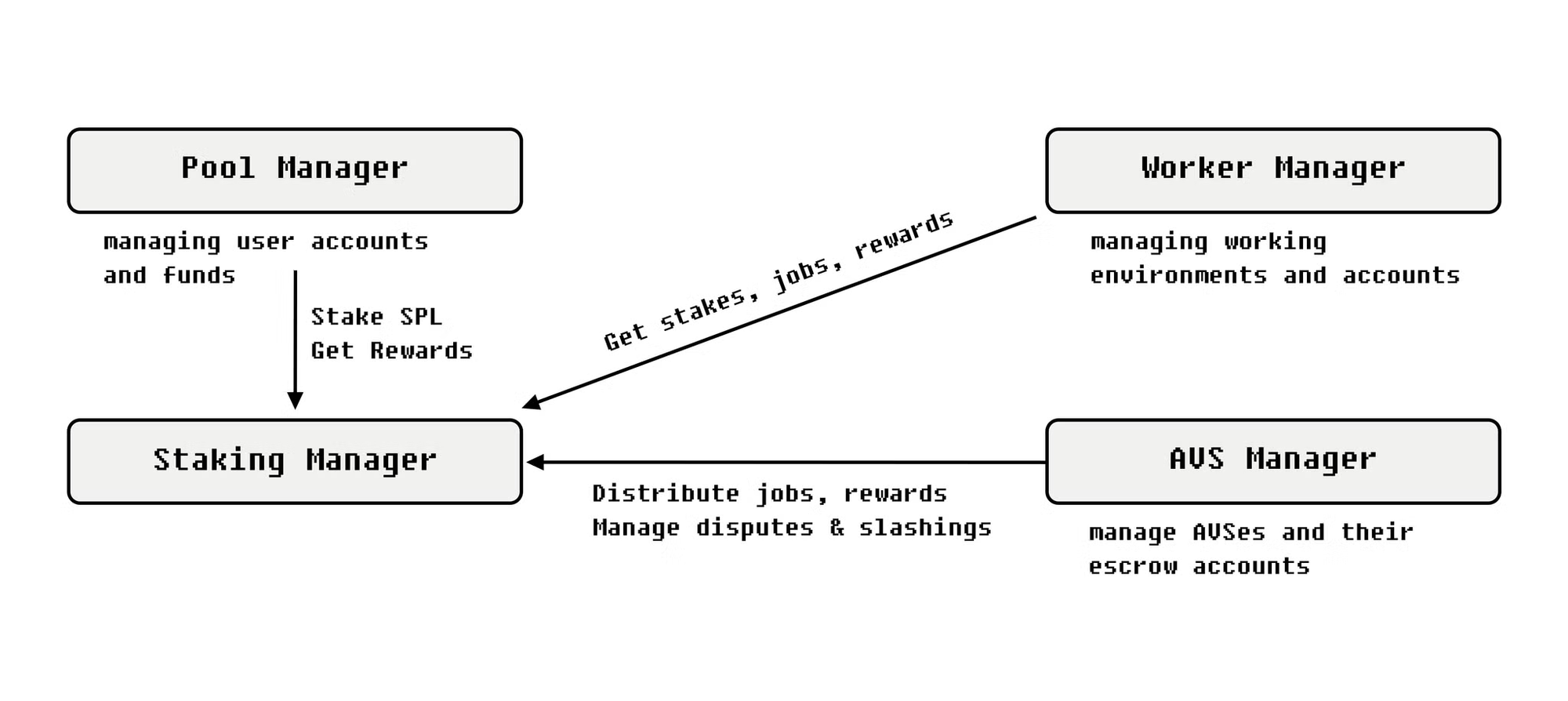

One of the most important components of Solana's staking system is the Stake Pool Program, which handles edge cases resulting from validator optimization based on an exponential rise in stake accounts. This tool allows particular types of assets, such as liquid staking tokens, to be created. It is one of the newest programs in Solana Program Library, yet it continues to play an important role in maintaining flexibility and efficacy within the ecosystem's stakeholders.

Participants in the Stake Pool Program

Participants in the Stake Pool program are put into three groups.

- Manager: A person who develops and runs a stake pool; he collects money in exchange and has the authority to change fees, managers, and staker.

- Staker: A staker redistributes stakes among validators and is in charge of adding and removing them from the pool.

- User: Adds $SOL or staked $SOL to an existing stake pool.

Operation of the Stake Pool Program

- Stake Pool Creation: Managers are responsible for creating stake pools. After the pool has been created, any user can use the deposit-sol instruction to deposit their $SOL into it. During this procedure, they will get pool tokens, or LSTs, which will grant them shares in the pool, and the deposited SOL will be added to the pool's reserve.

- Incorporate Validators: When a delegator submits the add-validator instruction, it adds certain validators to the pool. $SOL will be extracted from the pool's reserve to create a fresh stake and then allocated to the designated validators.

- Stake: Users who prefer to delegate their $SOL can, theoretically, put their accounts in any pool; as a result, they can delegate their stake to any of the many validators. In any case, the stake is activated one epoch later, in two days, at which time users can push it with the deposit-stake instruction.

- Reward Distribution: In exchange for allowing the pool to utilize their space, users get Liquid Staked Tokens (SPL tokens), which represent their proportionate share of the pool. When rewards collect in the pool, the LSTs increase in value. In the pool, the manager deducts an fee from epoch rewards.

- Withdrawal: During a pool token swap, users can withdraw their SOL using the withdraw command. Practically, this transaction returns the SOL that was deducted from the user's reserved SOL. The operation fails if there are insufficient funds in the reserve; otherwise, they can withdraw from an active stake account, which likewise uses the withdraw-stake command.

Secure the funds.

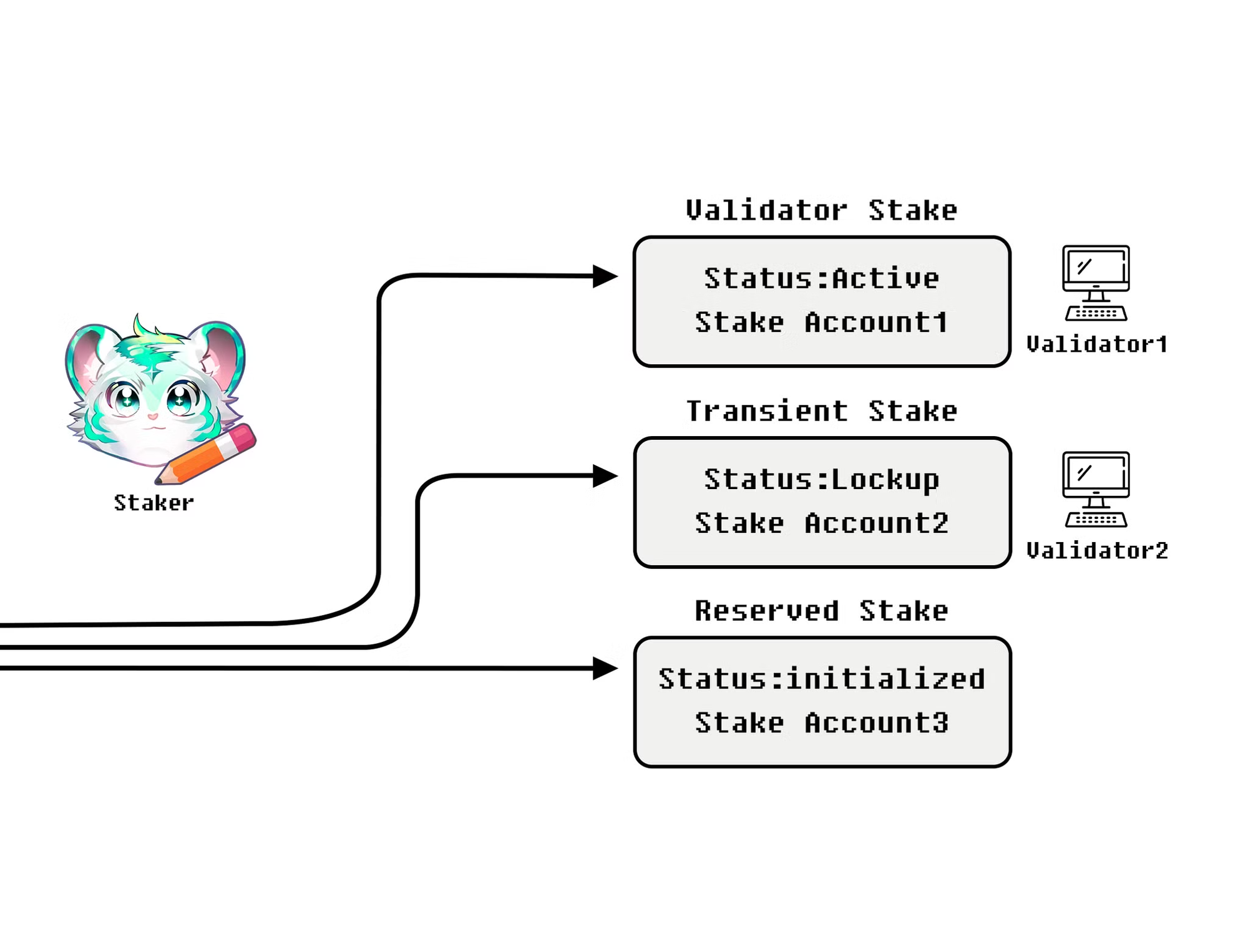

Some of the issues of the Stake Pool Program are: ensuring that pool token holders can always withdraw tokens; another such approach could be established by three separate types of stake accounts, as follows:

- Validator Stake: Each participating validator will have an active stake account hosted by the pool to ensure the pool's existence and distribute payouts.

- Transient Stake: Stakes that are currently being activated or disabled. After completing the process, they will be added to the reserve or validator stake.

- Reserve Stake: The stake is preserved and placed in a reserve for any idle stakes that a project may wish to call at a later point for rebalancing.

The "preferred withdrawal account"—the account from which a withdrawal should be made—would remain part of the stake accounts. Then, ensure that the feature respects the accounts used for withdrawals.

A function of temporary accounts and active stakes.

- Reserve Stake Account: This account is initialized during the stake pool creation process. It is used to fine-tune the undelegated stakes at various points along the process. It basically means that pools should be able to deal with stakes from several validators without compromising their existing stake in the network.

- The Validator List Account serves as the other de facto key in the Stake Pool Program data structure. Each stake pool contains two data accounts: the validator list account and the stake pool account. The stake pool account contains information on the general condition of the pool. This validator list account contains information on a legitimate, concrete validator stake in the participating pool. In essence, the Solana Stake Pool Program presents a strong mechanism to assure peak performance within staking by pooling resources to provide a structure that eventually allows for flexibility and adaptation.

- It also generates liquid staking tokens, which increase the units of the staked asset and allow users to swap their stakes without having to wait for a lengthy time (potentially days) during the unstaking phase. It boosted the value of stakes on the Solana network by allowing users to trace their stakes across a large number of validators and potentially extract funds.

Solana Staking Economics

Solana's staking economics create a complicated, multidimensional mechanism for balancing costs and rewards when hosting a validator node. The operational cost is the most important consideration for the validator; at best, it might reach $410 per month over a year. To get this value, we must factor in server and bandwidth costs. Just the server, if you utilize dedicated bare metal, will cost between $350 and $470 per month—not including additional service charges—to use services like Latitude. Validators must also account for on-chain voting costs, which are a type of transaction fee that applies to casting votes in each slot and can total between 300 and 350 SOL per year, depending on validator activity. Validators should also have a high-speed data connection, with at least 1 GB of download/upload speed. Data bandwidth costs can vary significantly between vendors, ranging from $0.64 to $3.60 with Latitude to more over $70 when acquired through AWS. (source)

Aside from that, the opportunity cost of validators is generally considerable. Running a validator necessitates securing a token, which is capital that could otherwise be utilized for a variety of yield-producing, risk-free assets rather than staking with other projects in the larger crypto world. Furthermore, running a validator requires a significant investment of time and resources, highlighting the importance of accurately calculating prospective profits.

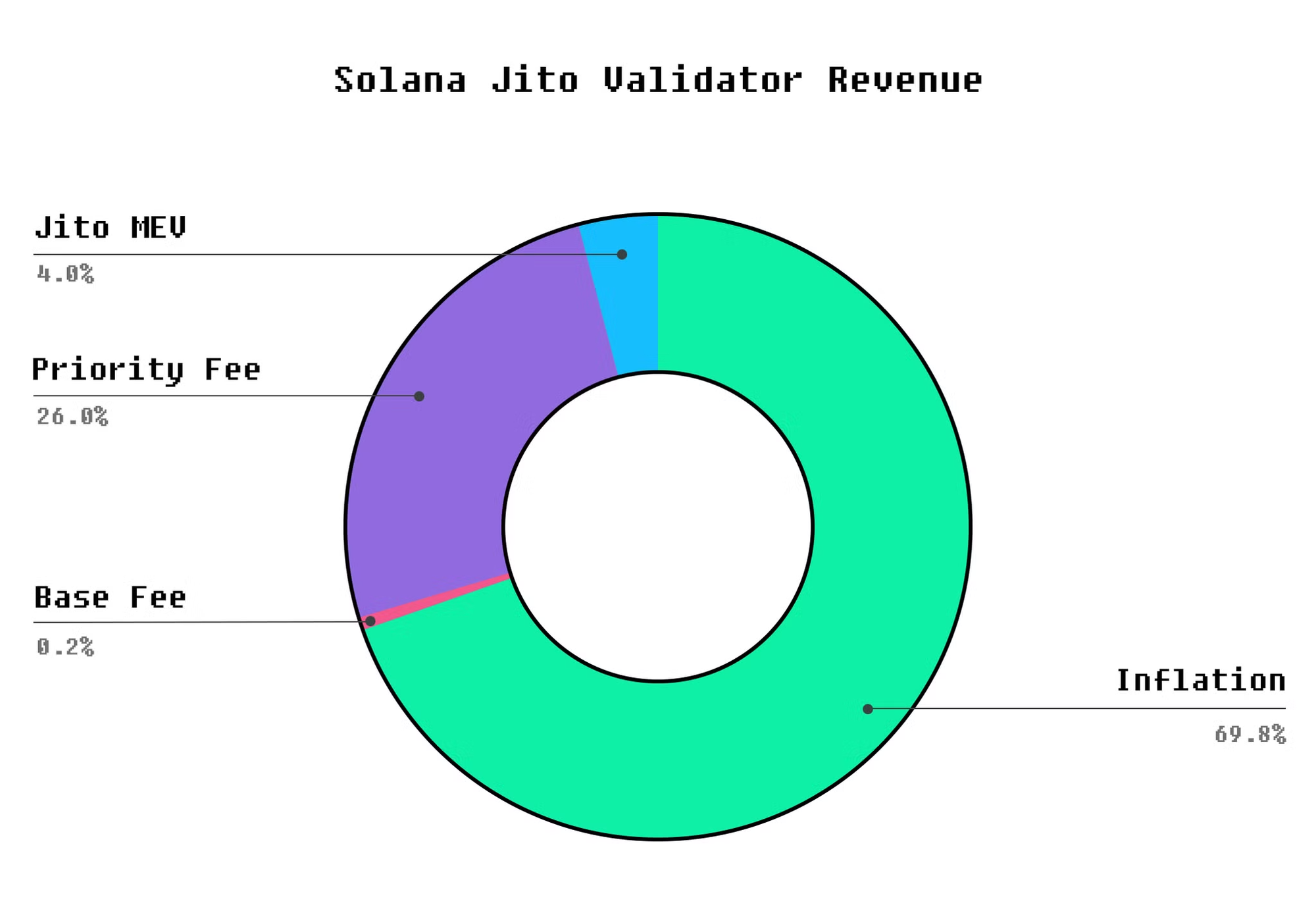

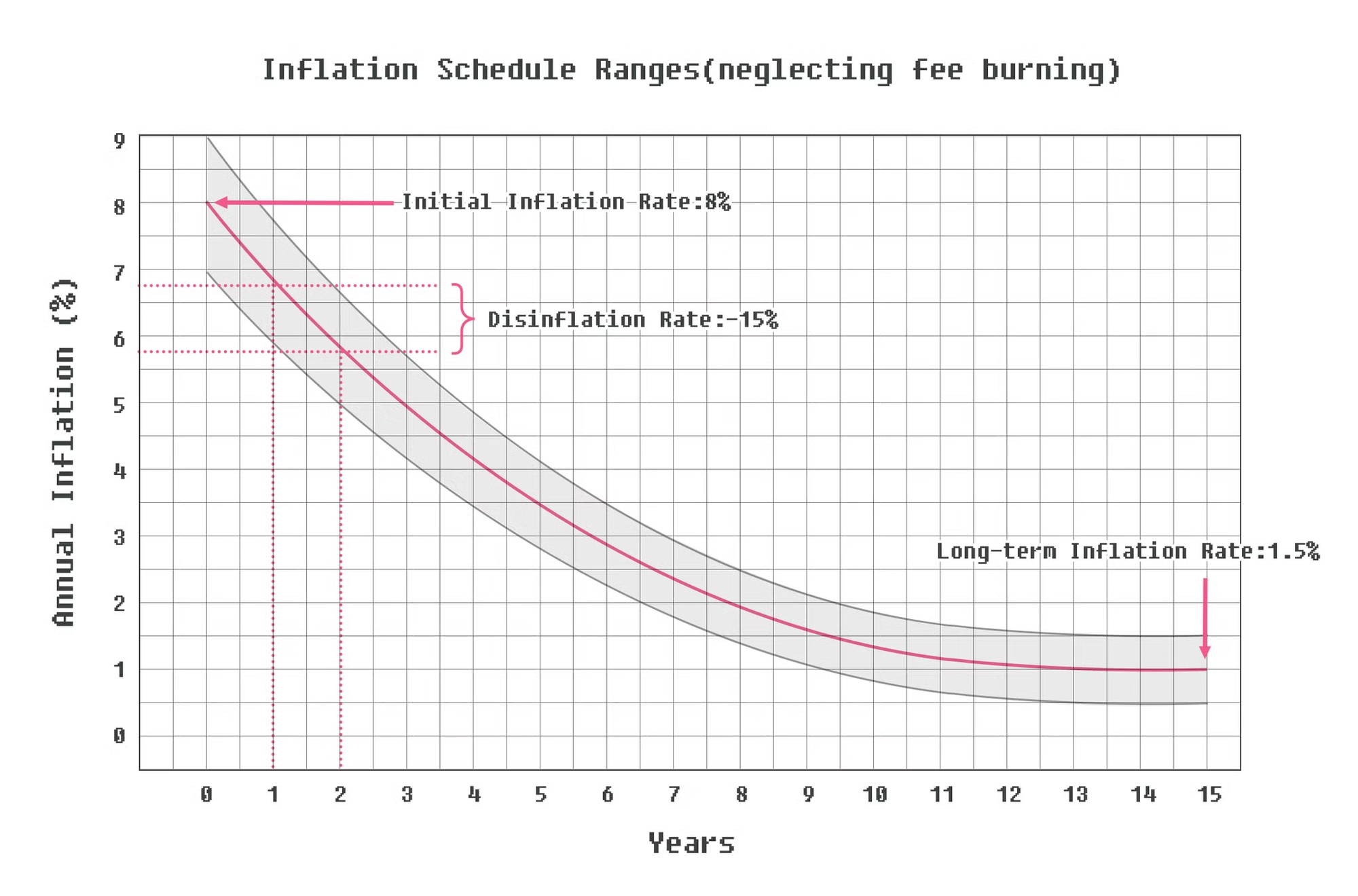

Validator incentives come from a variety of sources, the most prominent of which is Solana's inflationary model. Validators are compensated through inflation, which is subsequently dispersed to those who stake their SOL tokens. This inflation serves as a cost to non-staking SOL holders, thereby paying for network security by devaluing it. Over time, the inflating mechanism decreases dramatically, resulting in a significant fall in rewards.

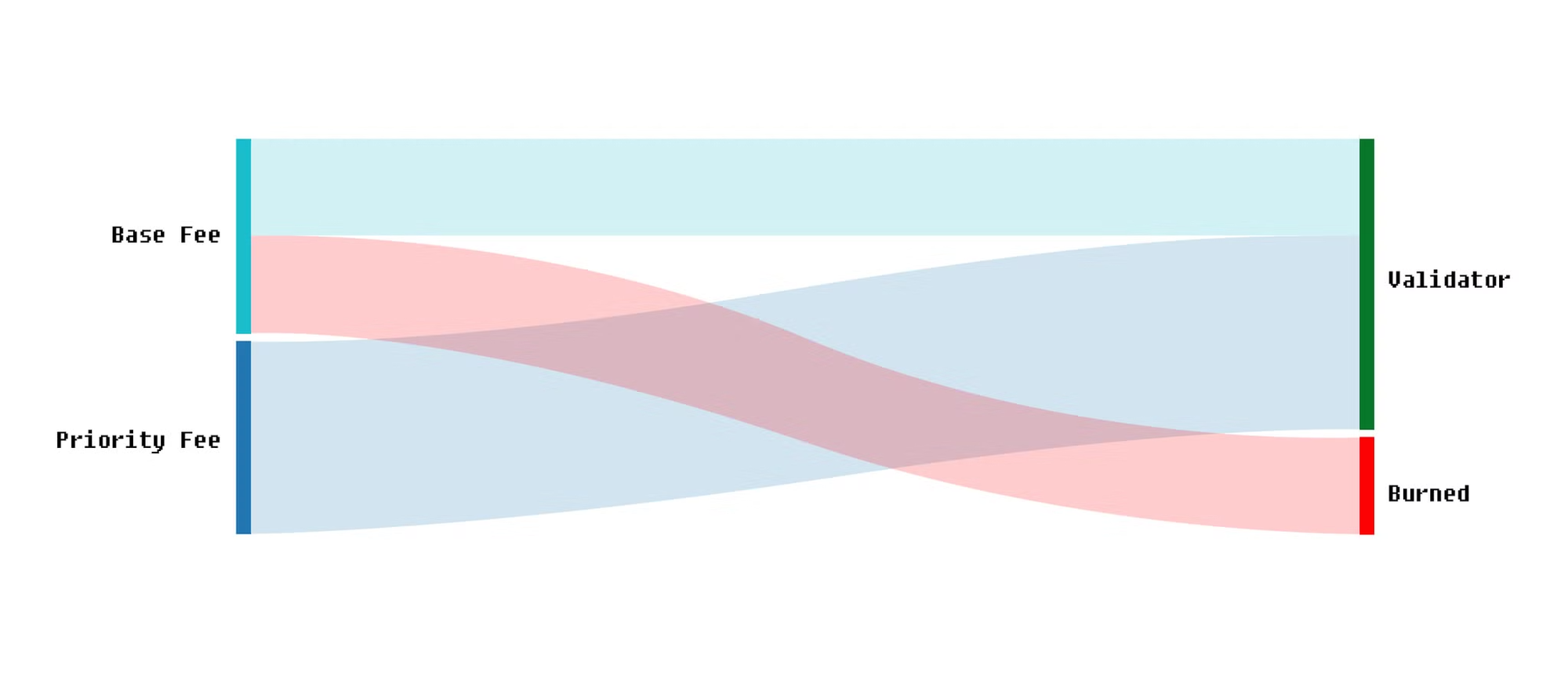

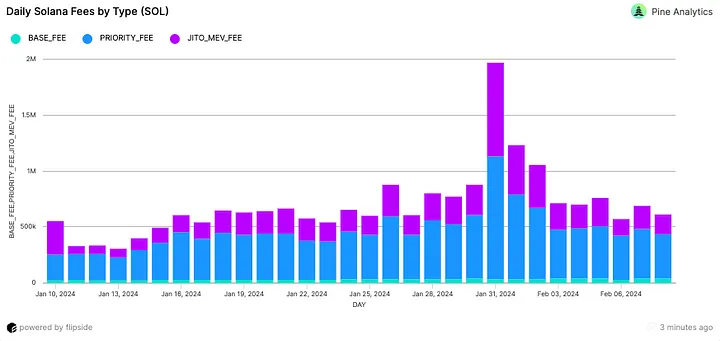

Validators are, in turn, SOL holders who, despite the risk of slashing, earn extra token from the incentives. Validators also obtain block rewards when they are chosen to create a block for specific slot. The block's transaction fees are divided into base fees (50% burnt, 50% given to validator) and priority fees (100% handed to the validator).

Maximal extractable value (MEV) generates additional revenue for validators. MEV indicates validators' ability to benefit by reordering, including, and omitting transactions in a block. While the MEV landscape on Solana is highly dynamic, it opens the door to even more incoming complexity for validators. Still, from an economic standpoint, there is no guarantee that the validator running continually in the Solana network will be lucrative, given the network's negative inflation, which has been reduced to a long-term aim of 1.5%. If all other parameters of the staking service remain constant, under similar staking rates and network configuration, it is reasonable to expect a 2.23% reduction in inflation rewards and a compression of validators' staking yields by 0.44% to 0.505%.

This diminishing gap means that a validator would require significant stakes—values ranging from $8.1 million (77.3K SOL) to $9.3 million (88.7K SOL) in SOL—to justify validation. Assuming profitability, only roughly 473 of the 1,637 validators may be able to earn surplus by the end of the inflation process.

The Solana network must strike a balance between maintaining profitability for the validator community. This could take the form of lower voting transaction costs for validators with large stakes, additional incentives, or increased network activity to boost fee revenues. In particular, an annual revenue volume of priority fees ranging from $200 million to $400 million could be a crucial enabler in maintaining validator earnings at their current level.

Other considerations include creating mechanisms to minimize spam on the network, as the low base charge scheme has resulted in Solana being targeted by numerous spam transactions. More than likely, it would draw on the many lessons acquired from examples like this one as well as more recent ones, such as Osmosis, in which selected entities placed an upfront cost to their transactions in order to effectively limit spam. Other modifications could include increasing the dynamic of the base fee structure, similar to Ethereum's upgrading approach, to assist balance transaction costs more fairly. Allowing fees to be defined natively in compute units would bring Solana transaction costs closer to the resources spent, making opportunity for a sustainable, forward-thinking, and completely equal price structure. This is meticulous work, however—a crucial distinction between Solana and Ethereum is the calculation of transaction costs at the most fundamental, inherent level. Such modifications, however, may be critical to the economic health of the network as well as the validators' place in the ecosystem.

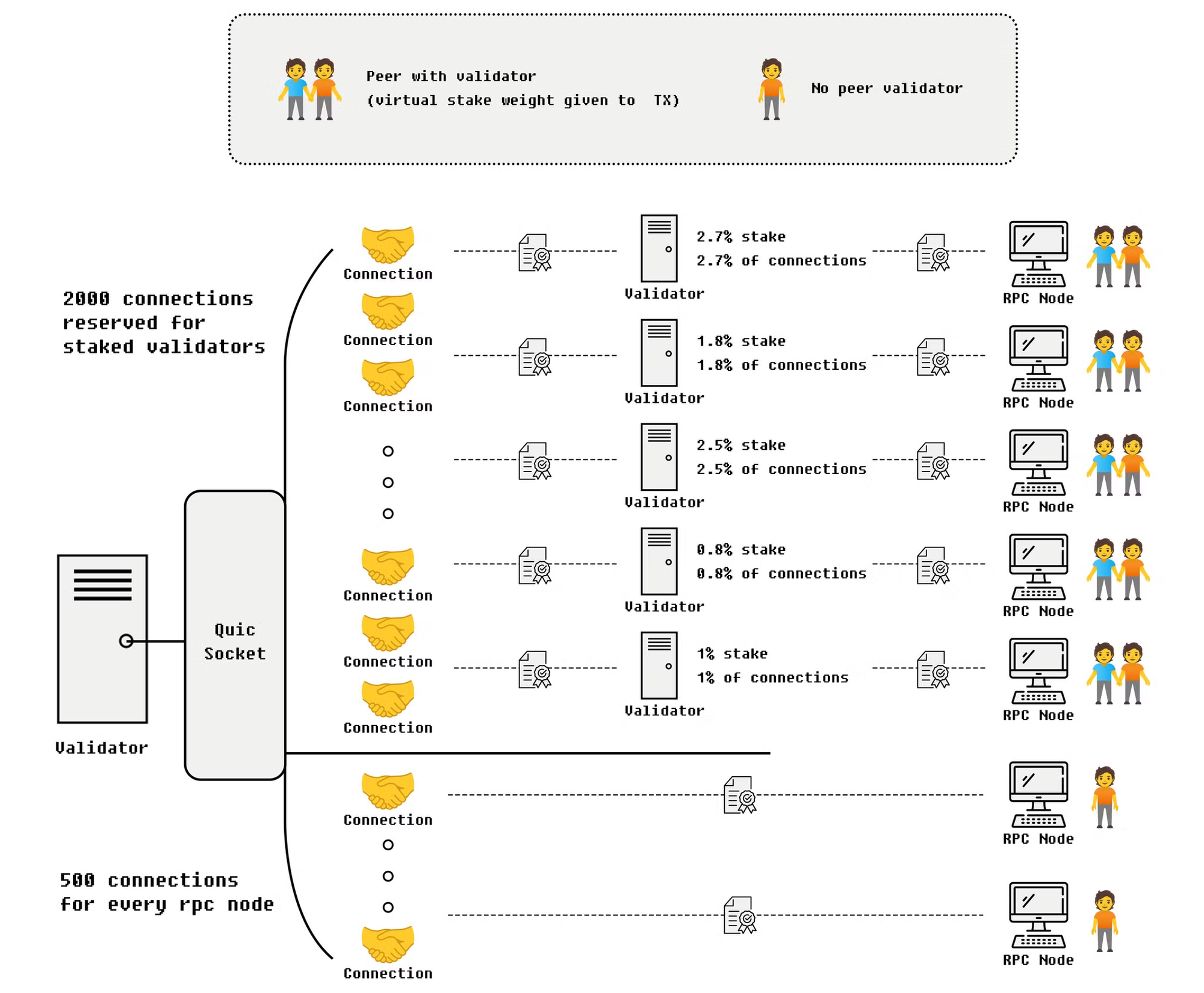

MEV in Solana: How Validators Works?

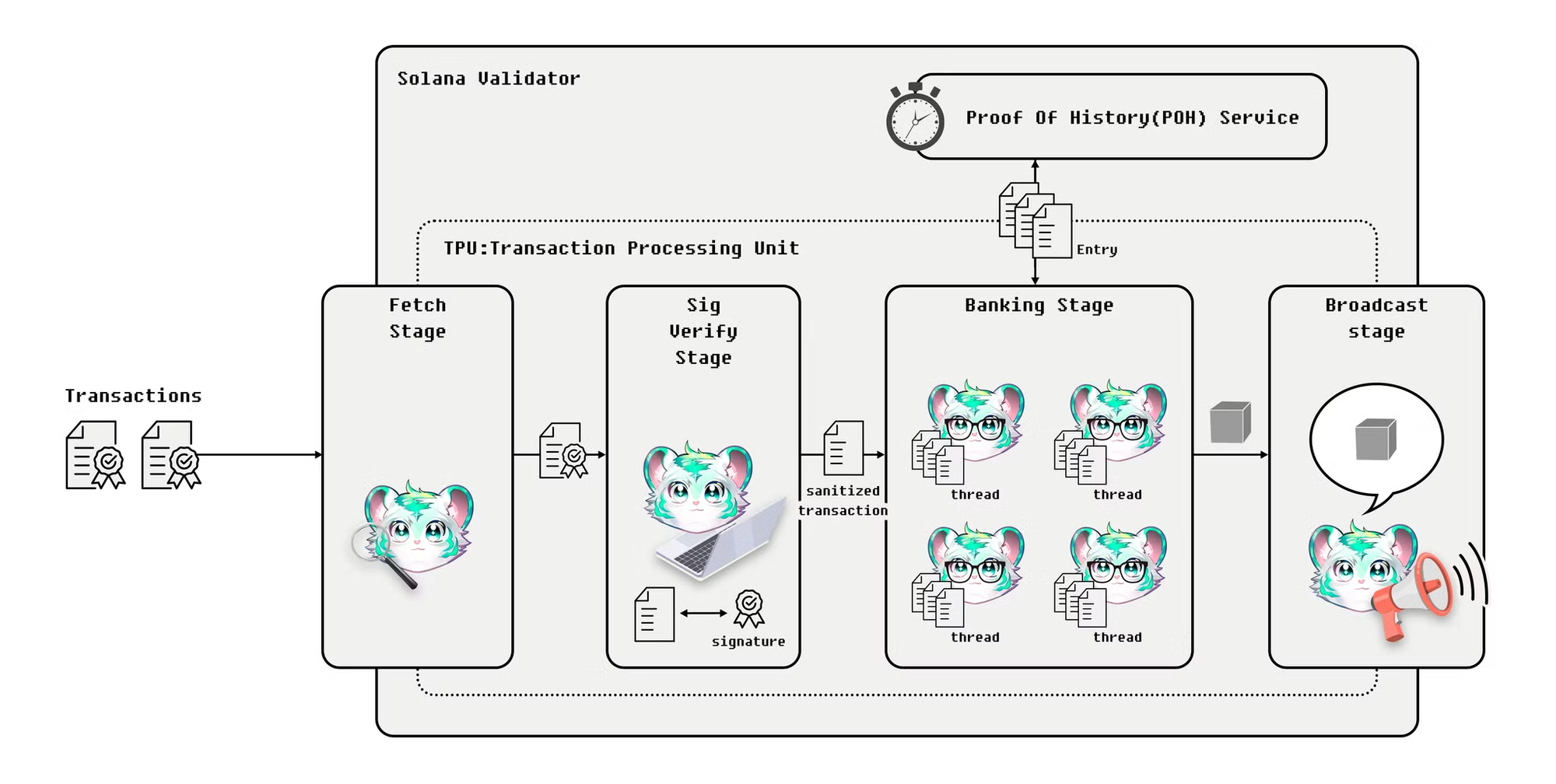

One of the most important aspects of Solana's network economics is maximal extractable value (MEV), which refers to a validator's involvement in deciding transaction ordering and execution. Understanding the process is crucial for identifying and pursuing MEV opportunities. The Solana validator workflow begins with the Fetch stage, which receives new incoming transactions from dedicated sockets that identify them by type. It then aggregates these transactions into 128-packet batches and sends them to the next stage for efficient large-volume transaction processing.

Validators in the SigVerify stage verify the transaction signatures in each packet. If the signature is invalid, validators will drop the transaction.

This stage is crucial to maintaining the network's integrity and ensuring that only valid transactions are handled. In high-throughput purposes, GPUs can handle at least a portion of the computational cost of signature verification. Finally, the algorithm that deletes extra packets based on their IP address defends against DOS attacks.

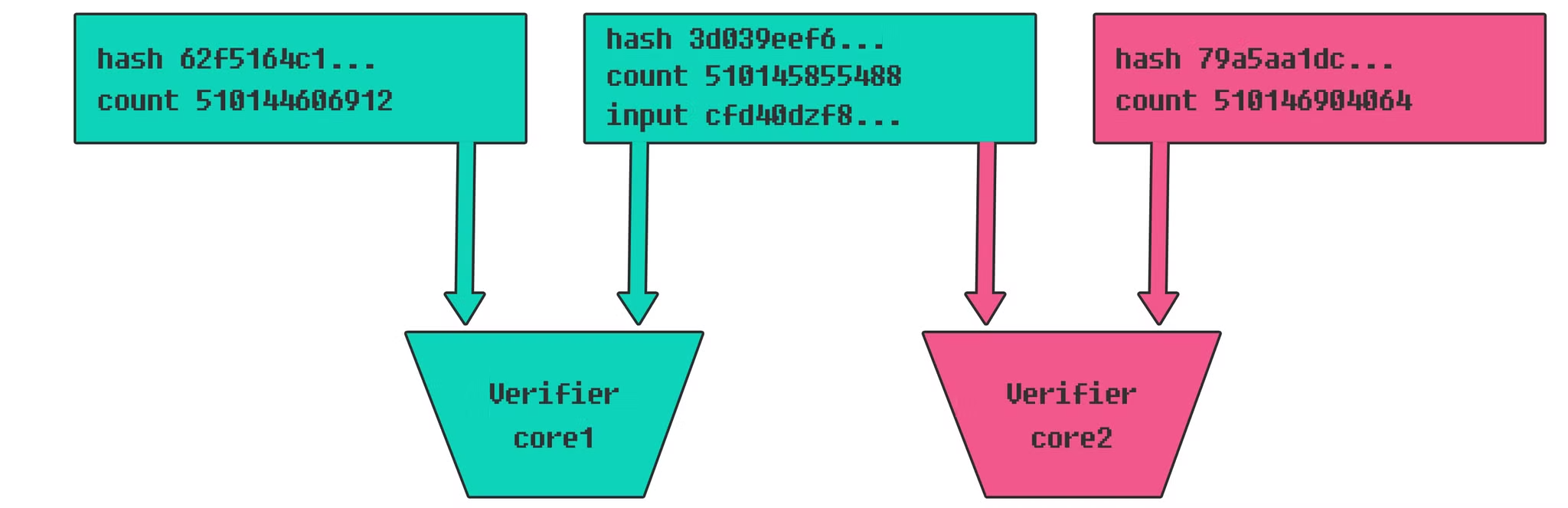

Essentially, the TPU divided verification into two pipelines: one for voting packets and one for general transactions. This ensures that typical transaction flow does not disrupt a network's consensus process.

The permitted transactions advance to the banking stage, where individual threads process packets from various groups. As the current slot's leader, the validator delivers these transactions using a Quality of Service (QoS) model after deserializing them into 'SanitizedTransaction' objects. This QoS model emphasizes aspects like instruction data length and Program ID access pattern during execution to boost the Solana network's throughput and efficiency.

These are the transactions that Solana's runtime, Sealevel, can handle because the QoS model has chosen them and packaged them in a batch for parallel execution. This is possible because the programming model explicitly separates code from state. The TPU distinguishes accounts as readable or writable to prevent data races during simultaneous transactions. The PohService receives the results of each transaction once it has been completed.

The Proof of History (PoH) Service generates a cryptographic record of events in chronological sequence via "ticks" within a slot. It starts a running hash loop that produces output until it receives data from the banking stage. If a record is received, it will be hashed with the previous output to generate a new hash, which will then be used as the foundation for the next record, cryptographically safeguarding and ensuring the block's transaction sequence.

Transactions are broadcast to the network after engaging the PoH service. In essence, it is an especially developed system for efficiently distributing blocks. This implies that the Turbine protocol converts transactions into shreds (the smallest unit of block data) and propagates them around the network. Each node in the network receives a portion of the block and distributes it to downstream nodes for creation, resulting in extremely rapid data transport throughout the network.

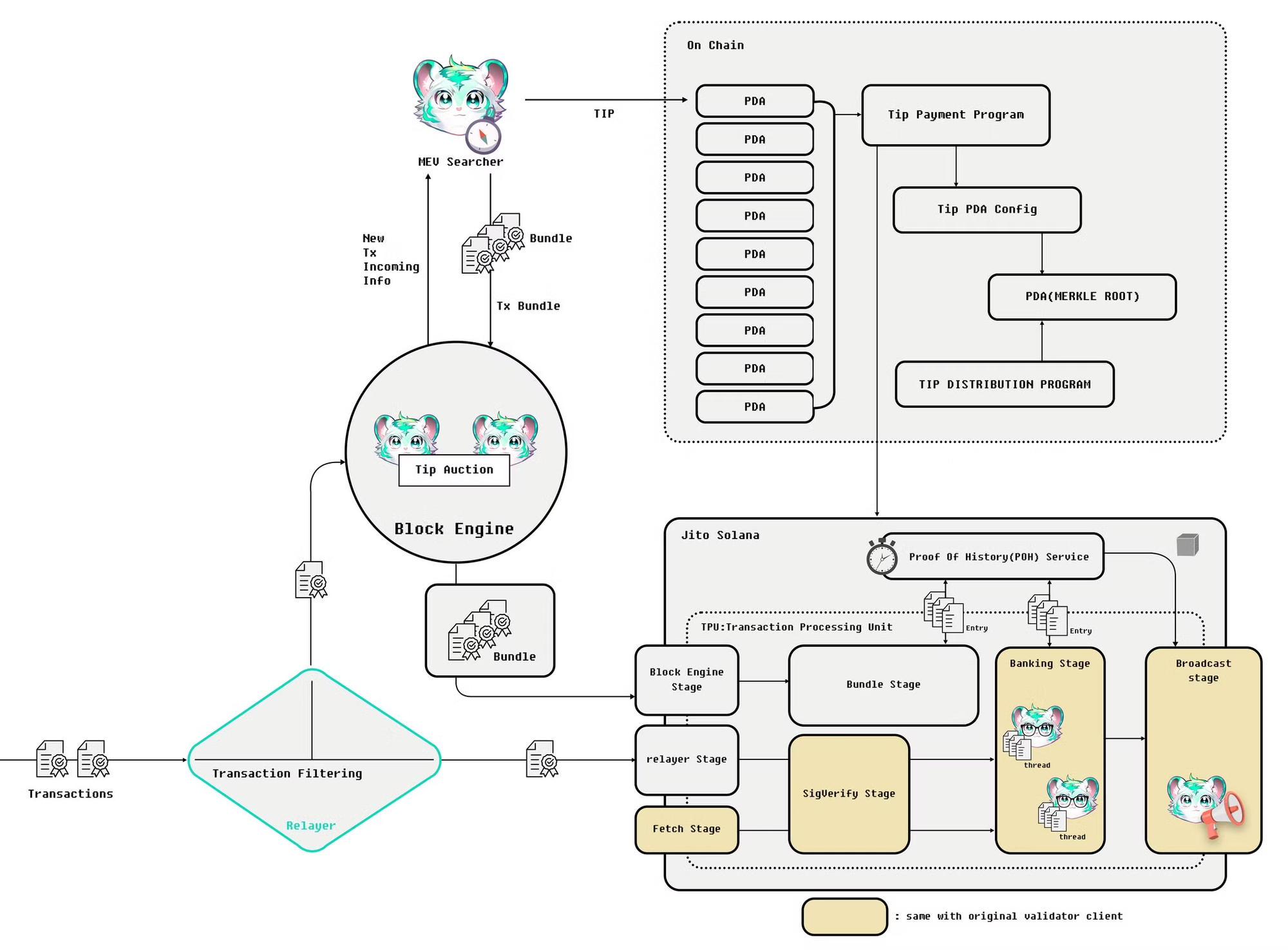

In Solana, how MEV can function becomes clear when we examine how transaction processing is carried out. Relayers and block engines act as intermediaries between a validator and the wider network, allowing for MEV opportunities. In Solana's developing MEV ecosystem, relayers might reorder or include more MEV bundles at the fetch stage. These MEV bundles, which are frequently produced by searchers who identify a profitable opportunity, are accepted and prioritized by the relayer, allowing them to be carried out right after a certain transaction (back-running). This effectively captures MEV opportunities while increasing the potential earnings for searchers and validators. Relayers oversee the flow of shreds for both ordinary transactions and voting, ensuring that validators receive the data they need to do their work and that inclusions are optimized for MEV transactions. And, the relayer may temporarily prevent some transactions from being delivered to the validator in order to include them right before a MEV bundle and enable a searcher to capture value within a block. Detailed architecture will follow the next chapterMEV in Solana (2): Jito MEV Overview

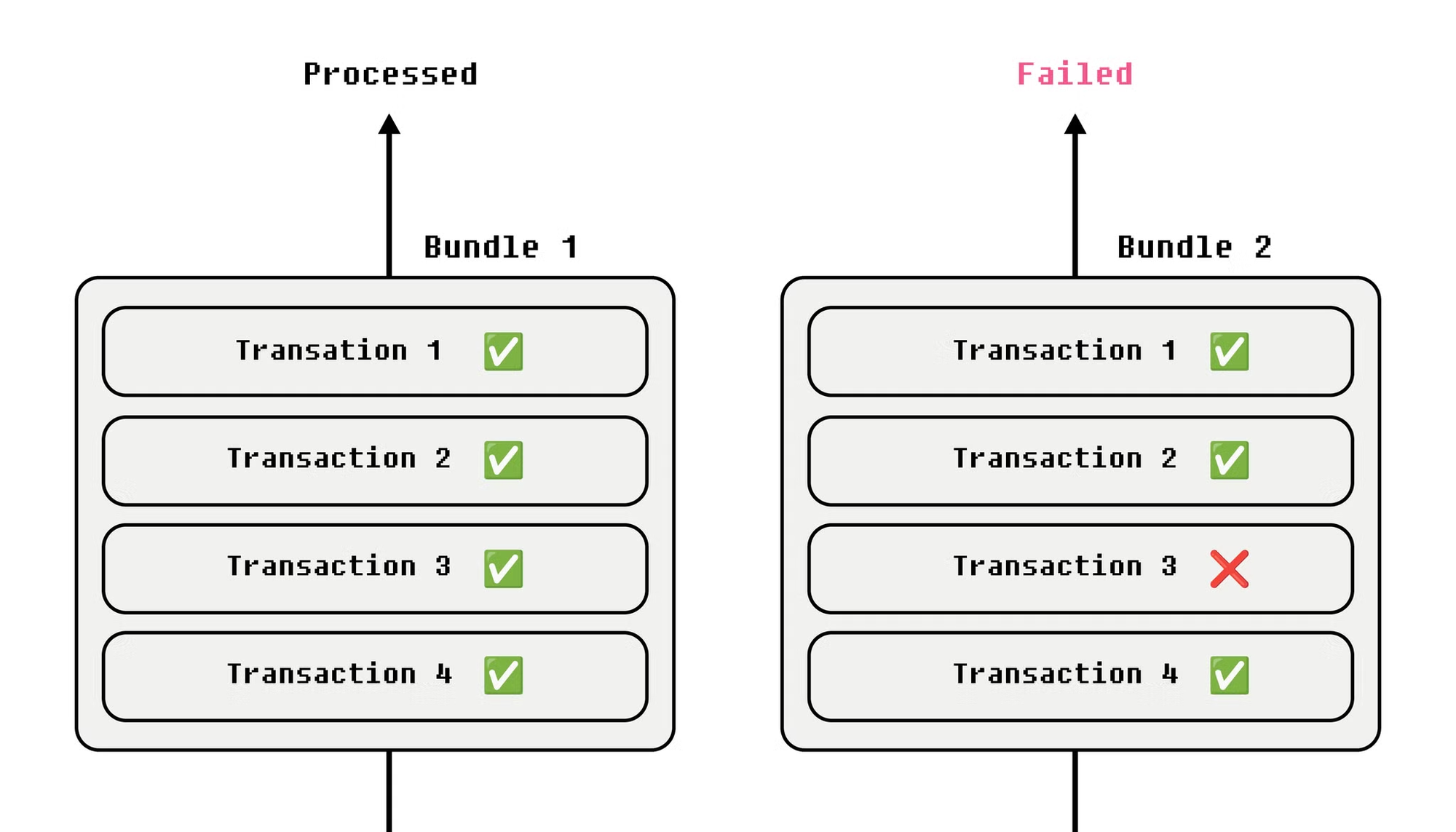

In Solana, Maximal Extractable Value (MEV) creates new economic opportunities for validators by utilizing components such as bundles, relayers, and block engines. These components are essential to a transaction processing system that optimizes transactions for execution, assuring optimum MEV profit while maintaining network efficiency and stability.

Bundle

A bundle in Solana's MEV ecosystem is a set of transactions that are carried out in a certain order. The order in which these transactions occur is critical, particularly in cases such as arbitrage or liquidation, when the outcome of each transaction is dependent on the prior one. Bundles follow the "all or nothing" approach, which means that if one transaction in the bundle fails, the entire bundle is rolled back and not processed. This prevents partial execution, which could result in unforeseen consequences or losses. Bundles can include tips, which serve as incentives for validators to prioritize and incorporate them into the block.

Jito Relayer

The Jito Relayer serves as an important bridge between the validator and the wider Solana network. It checks and verifies transaction signatures before sending them to the validator, ensuring that only valid and potentially profitable transactions enter the execution phase. When a validator connects to the Jito Relayer using gRPC, it effectively disables its TPU (Transaction Processing Unit) and passes all transaction packets to the relayer instead. This configuration enables the Jito Relayer to efficiently manage and optimize the transaction flow. It accomplishes this by temporarily storing specific transactions in memory in order to strategically inject MEV bundles from the block engine that are identified as having the most value. If the relayer fails, it features a backup mode that ensures transactions are executed uninterrupted, which is critical for the network's overall stability. Furthermore, the Jito Relayer forwards only transactions that are most useful to the block engine, giving enough time for both the block engine and searchers (entities that hunt for MEV possibilities) to simulate and process these transactions.

Jito Block Engine

The Jito Block Engine is an important component in the extraction of MEV inside the Solana ecosystem. It is in charge of accepting high-value transactions from the Jito Relayer and delivering them to searchers for further value capture. The block engine, which simulates and evaluates the results of transactions, is critical in determining which are the most profitable. After the simulations are completed, the block engine accepts these transactions for execution. The Jito Block Engine charges a 5% fee on the MEV tip, which is only applied to the additional profit created by MEV operations and has no effect on ordinary staking rewards.

Jito-Solana

Jito-Solana is a forked version of Solana Labs' validator client that is specifically intended to handle transaction bundles. This enhanced client connects to relayers and block engines via gRPC (a high-performance RPC framework), allowing it to handle larger packets than normal UDP. The ability to process larger packets is critical when dealing with complex transaction sequences involving various sorts of data. Jito-Solana not only handles bundles but also has a tip-payment system. This protocol allows validators to collect tips in return for prioritizing specific transactions, giving them an extra incentive to handle high-value transactions immediately.

Tip Payment Program.

The tip payment mechanism in Solana's MEV ecosystem improves transaction efficiency by allowing searchers and users to tip validators using static public keys, assuring proper leader payment despite Solana's frequent leadership turnover. It eliminates bottlenecks by leveraging eight static tip accounts, allowing for simultaneous bundle execution across many processing threads, hence improving transaction performance and distribution. Furthermore, the software is intended for scalability, with the option to enhance parallelization via TxV2, further enhancing the system's capacity to handle large volumes of transactions.

Tip Distribution Program

The tip distribution mechanism efficiently collects and distributes MEV profits to validators and delegators, with Jito taking a 5% fee. At the start of each epoch, the validator client establishes a unique TipDistributionAccount that aggregates MEV over time. When the epoch ends, a snapshot of the final slot is taken, and a script creates a merkle tree outlining the MEV claims for each validator and delegators depending on their contributions. The merkle root is then uploaded on-chain, allowing validators and delegator to claim their MEV rewards as airdrops while accounting for the 5% fee, ensuring transparent and equal distribution.

MEV in Solana (3): State of MEV

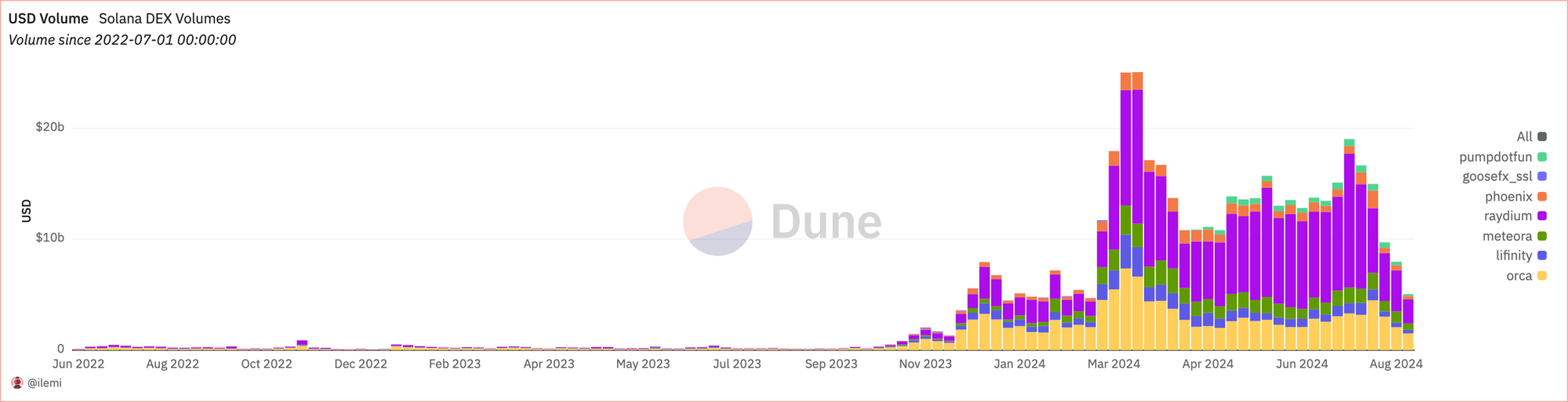

Currently, the features of this network greatly influence MEV on Solana. There are two examples: low transaction fees and no mempool. Their intersection generated a fertile field for MEV opportunities, especially when searchers flooded a network with identical transactions in an attempt to capture profitable arbitrage or liquidation opportunities before others did. MEV strategies generated around $36 million in returns in 2022 alone, mostly through arbitrage and liquidation.

In the first half of 2022, an arbitrage event using USDC yielded a median profit of $0.0168. Even with these razor-thin margins, the high volume—14.8 billion in the first half of 2022—allows for large total profits of $36 million. Transaction volume in the first half of 2024 reached more than $308.6 billion, indicating that MEV prospects will grow tremendously. The market has expanded so much that determining the exact worth of arbitrage opportunities has become impossible. Due to network security improvements and severe competition, acquiring MEV by spamming gets increasingly difficult, indicating a considerable increase in the scope and volume of MEV operations.

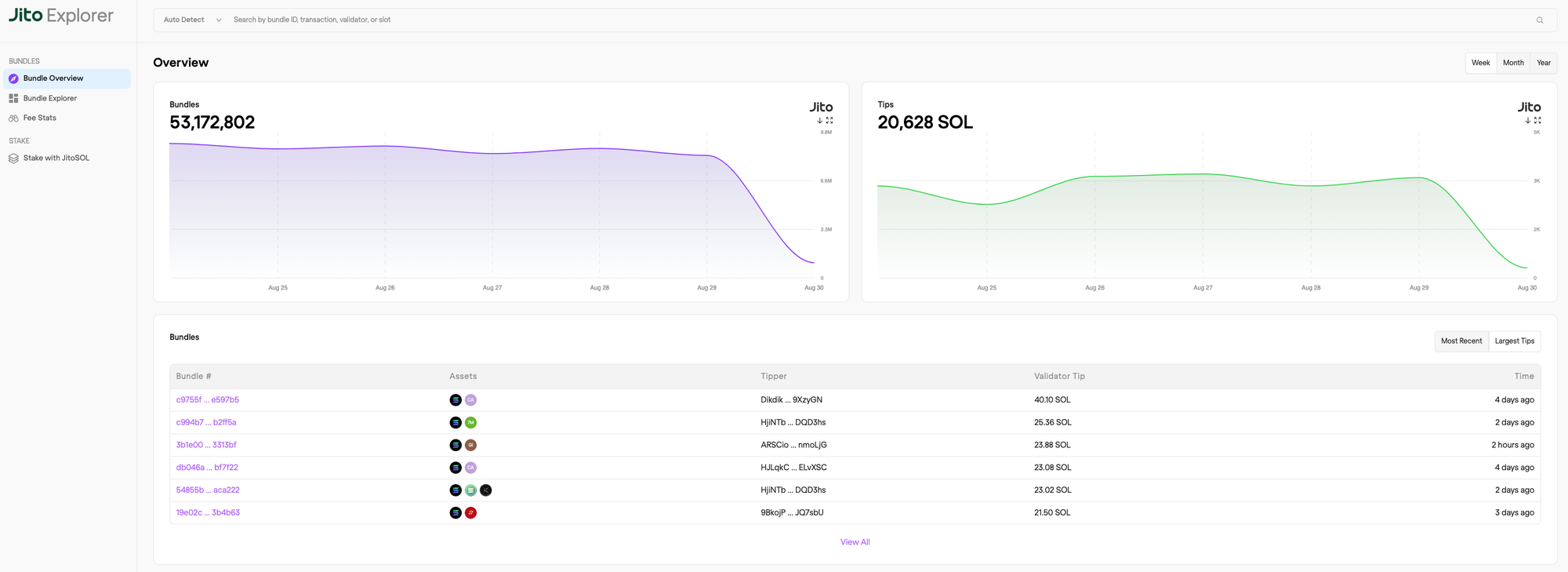

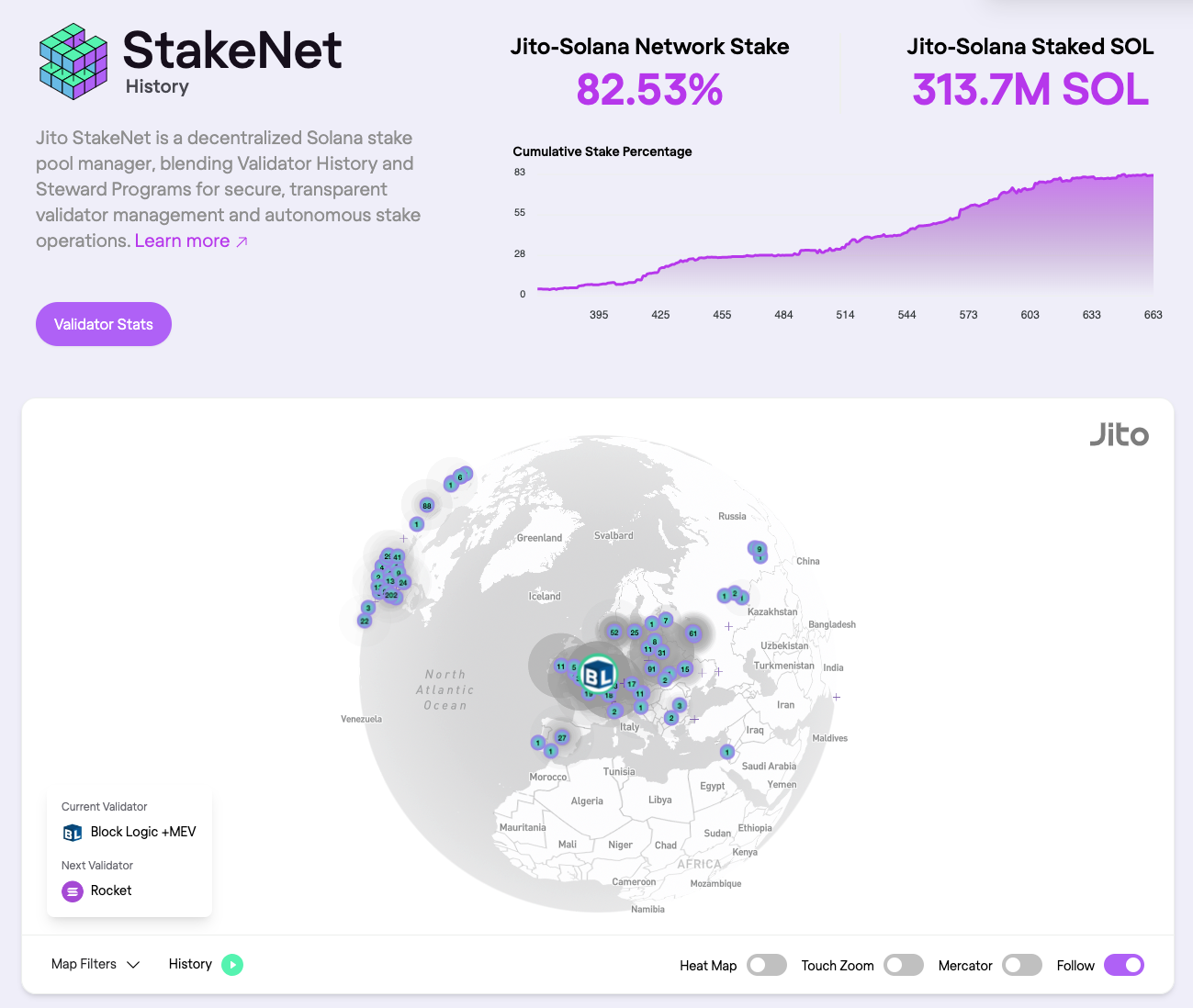

Validators using the Jito-Solana client, which supports bundles of transactions, profit from a tipping mechanism in which searchers tip them to prioritize their bundles. This has become an everyday aspect of how MEV flows work in Solana. Jito Labs has open-sourced their code since 2022, allowing any validator on Solana to use it to earn a share of MEV from searchers; today, those running the Jito-Solana client obtained a delegation of 81% of staked assets. Jito Labs has gotten 342,771,563 bundles from the block engine in the last month alone, for a total of 26,204.056 SOL. Jito Labs deducts 5% of the tips for using block engines and delivers them to a specified address. Stakers receive the remaining 95% based on their delegation in SOL.

Jito periodically converts MEV commission to USDC, which totaled nearly $2.1 million in the last month alone. For example, in the last month alone, stakers gained an additional $42 million in MEV-related revenue. Adjusting for the 46.6 billion SOL invested, this yields an additional anticipated 1% APR for stakers. Overall, including MEV into Solana's staking economy increased validator profitability and provided new benefits to stakers, significantly enhancing the network's overall economic landscape.

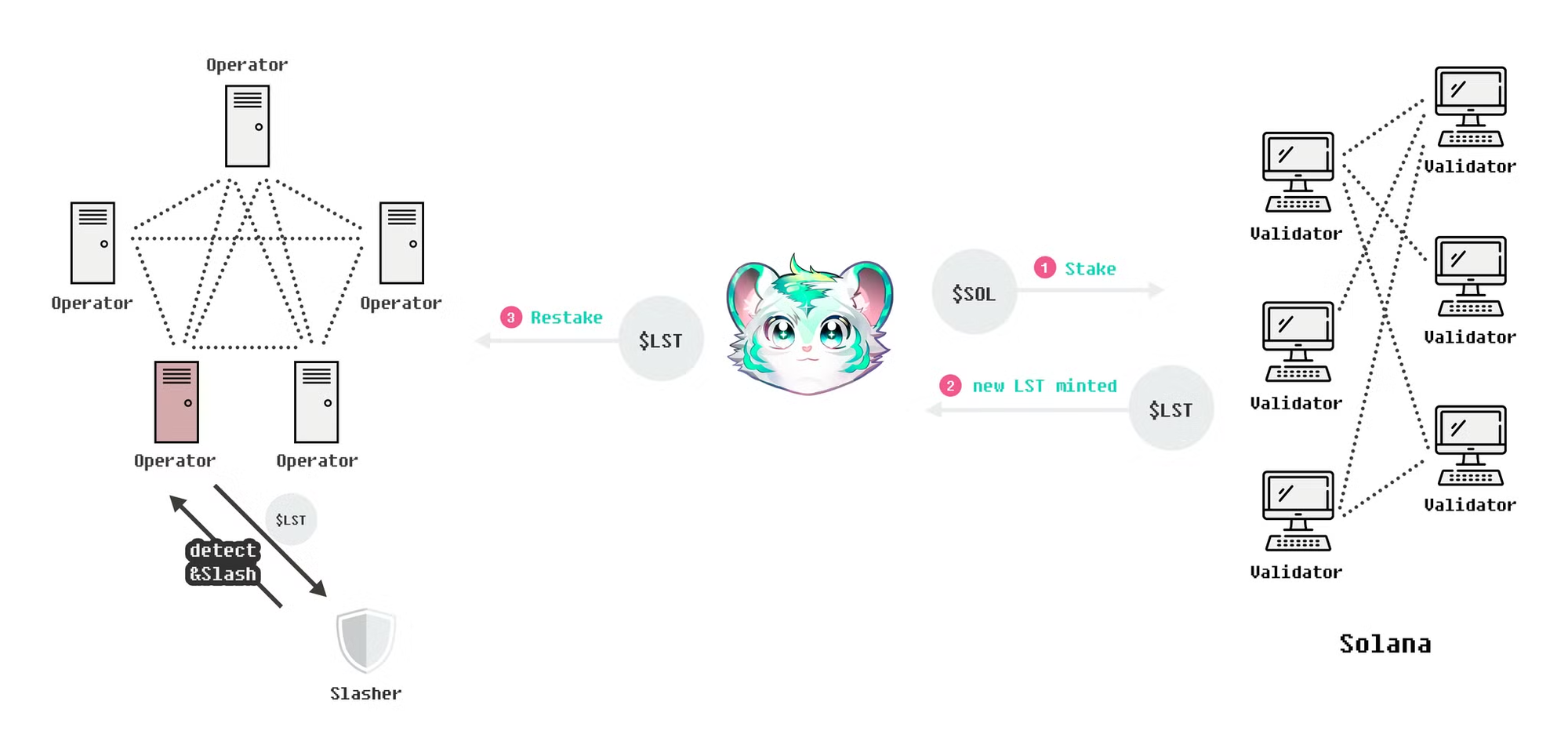

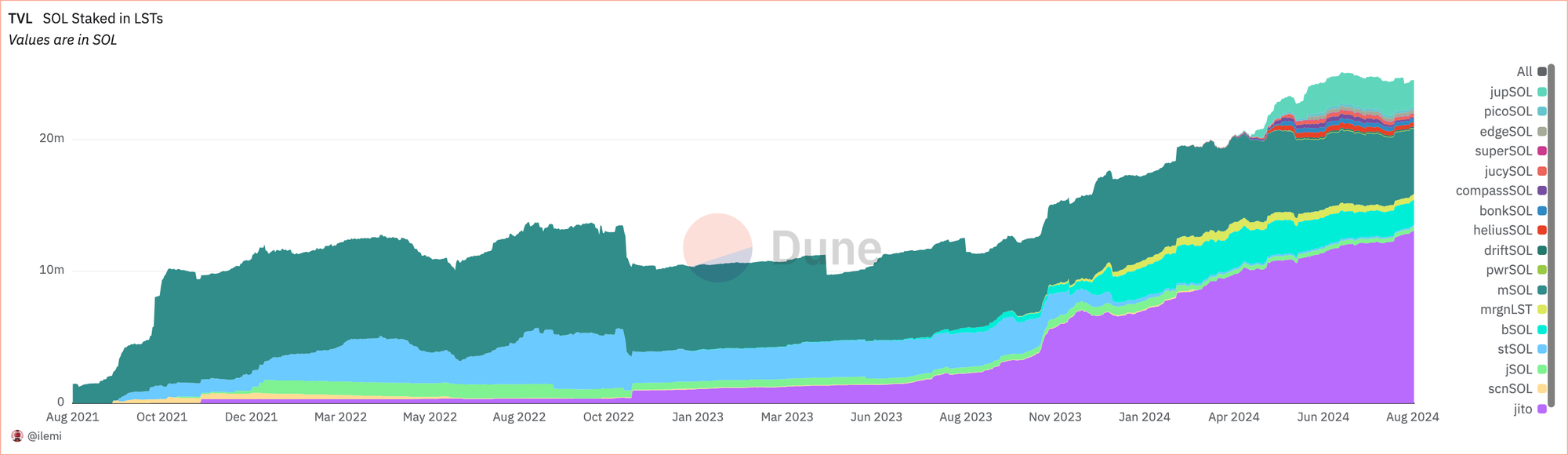

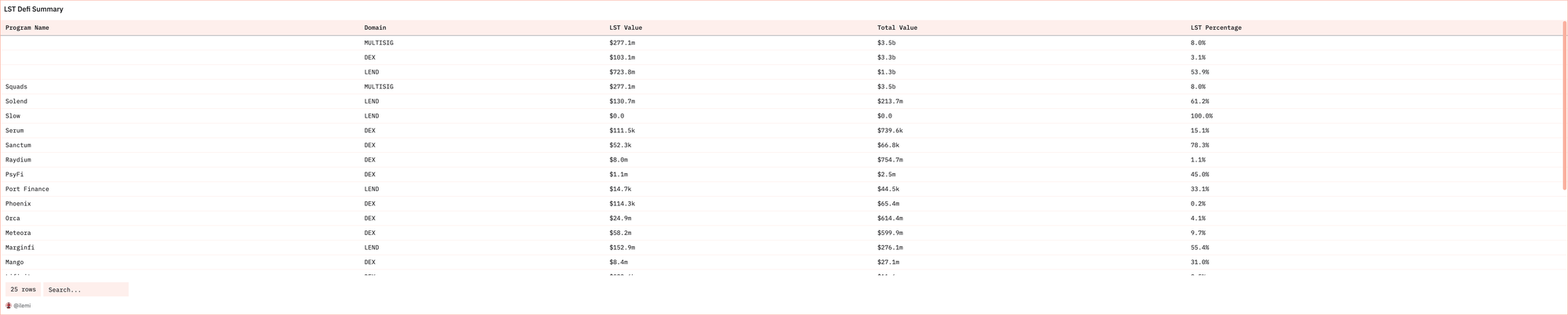

LST in Solana

Liquid staking tokens, or LSTs, are one of the most imaginative inventions in the cryptocurrency world today. Token staking is the process of securing tokens on a network in order to safeguard them and earn incentives. However, staking often reduces the token's liquidity by requiring an unbonding period before the user can access the staked tokens again. Liquid staking eventually solves this problem by creating LSTs, which operate as internet bonds, reproduce the staked position as new digital assets, and make it easier to trade or use decentralized finance (defi) systems.

A user who stakes their SOL receives a token, such as stakedSOL, that represents an LST. Many different DeFi systems can use stakedSol, which is a tokenized version of a staked position. Users can supply extra liquidity by transferring their LSTs to AMM pools and receiving a yield, or by using collateral tied up in lending activities. These adaptable solutions enable users to capitalize on staked assets' potential without having to wait for the conventional unbonding period. As a result, liquid staking is a tempting approach to maximize payouts while maintaining liquidity.

However, there are certain additional risks associated with liquid staking. Including smart contracts in the staking process would make such schemes more difficult and subject the user to additional dangers. These dangers include the possibility of a smart contract bug allowing an attacker to mint more LSTs without staking SOL, as well as an attacker finding a way to contact-exploit them in order to unstake the staked SOL.

Furthermore, the LST values reflect both the staked SOL value and the locked-in incentive. However, because the value of LST varies with market values, borrowers of other assets collateralizing LST face liquidation risk. This could spark a market crisis and temporarily devalue the stakedSOL. Consider an attack in which an attacker shorts LST while also creating significant quantities of LST by staking Sol, which they then dump on the market. The attacker will profit if the LST price goes significantly below where it should be. The loan platform's urgent price reduction causes liquidation, which increases the price fall. The attacker then purchases the stakedSol and unstake it to Sol. LST is a tricky investment. So, be cautious while using a new form of LST or engaging Defi with LST.

Approximately 30% of Ethereum's total supply is being staked. Investors own 65% of the Sol supply. However, LSTs make up only 5.2% of total SOL stakes on the market. Eth-LST accounts for 40% of the staked Ethereum. This demonstrates that Solana's liquid-staking ecology is still in the early phases of development. DeFi networks, on the other hand, aggressively use liquid staking. Marinade Finance launched the first-ever LSD on Solana, laying the path for what may become a large ecosystem centered on liquid stakes. Because of their significant liquidity contributions, LSTs are beginning to play an important part in the key advancements of DeFi in Solana. Following that, they take additional steps to encourage expanded stakeholder participation and provide their users with new revenue opportunities. We'll continue with a full overview of Solana's rising LST ecosystem and the implications for the wider cryptocurrency industry.

LST in Solana : Marinade Finance

Marinade Finance is Solana's first liquid-staking protocol and one of the ecosystem's the innovators. Marinade's liquid staking token, mSOL, represents roughly 22% of Solana's total LSTs. Marinade Finance's adventure began in March 2021, when the team achieved widespread acclaim by winning third place in the Solana X Serum DeFi Hackathon. That was an introduction to the DeFi space, and it led to collaboration with a company building on a liquid staking prototype for the NEAR protocol, which enhanced the Marinade infrastructure, particularly its RPC capabilities.

Marinade officially launched its liquid-staking service on Solana on August 2, 2021, after a successful test version on Devnet in May. The launch was a fast hit, with over 870,000 SOL staked within the first month, suggesting extensive user adoption and platform trust. Marinade did not stop there; they also established essential partnerships to ensure mSOL's broad integration into the greater Solana ecosystem upon launch. It agreed to partnerships with platforms such as Sonar, Saber (shoutout to OG who remember the brothers), Orca, and Switchboard.xyz to track yield farming performance, facilitate stable swaps, and gain access to liquidity pools for managing mSOL and SOL price feeds—another partnership that increased the value and interest in Marinade's liquid staking offering.

Marinade Finance has been distinguished by its commitment to decentralization and objective risk management since the beginning. Marinade, unlike most other platforms, did not run any validator nodes. This system functioned entirely through delegations, which divided staked SOL across multiple validators based on decentralized criteria. This helped to reduce the risks associated with single points of failure and reinforced the concept that this platform actually believes in decentralization.

Furthermore, Marinade used a decentralized financing strategy, with grants from the Solana ecosystem subsidizing the project. As a result, the absence of external stakeholders (investors) with competing interests prepared the ground for the eventual development of a DAO, governed by holders of the MNDE token, which was distributed among early protocol users, liquidity providers, and other community members. This distribution approach boosted the incentive to invest more in Marinade, resulting in a more robust and engaged community.

Marinade's commitment to decentralization and community governance was essential in its success over Lido, a well-known Ethereum liquid staking provider that launched on Solana in September 2021, just one month after Marinade. The MNDE token distribution strategy not only reinforced Marinade's position, but also gave it a competitive advantage in the Solana ecosystem. While Lido rapidly expanded before ceasing operations on October 16, 2023, Marinade remained strong, competing vigorously in the liquid staking market alongside Jito, Sanctum, and Marginfi.

Marinade's resiliency in the face of competition demonstrates the potential for unleashing its power through a responsive community and governance framework. From a hackathon project to the cornerstone of Solana's burgeoning DeFi ecosystem, these stories show how community engagement, along with strategic relationships, may result in a long-lasting, productive platform. With the ecosystem continually expanding, Marinade's early and consistent commitment to these values will put it at the forefront of staking liquidity and decentralized finance on Solana.

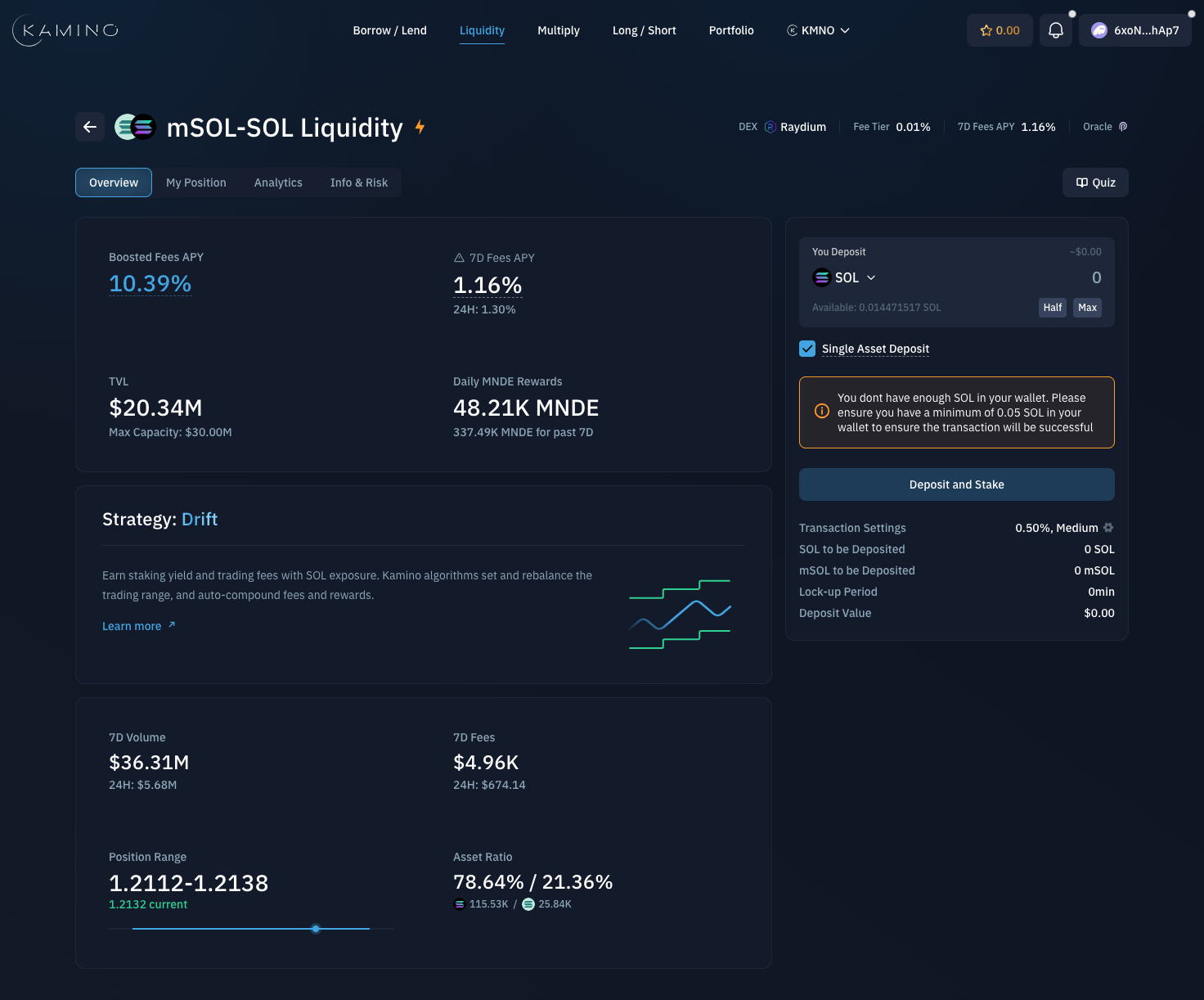

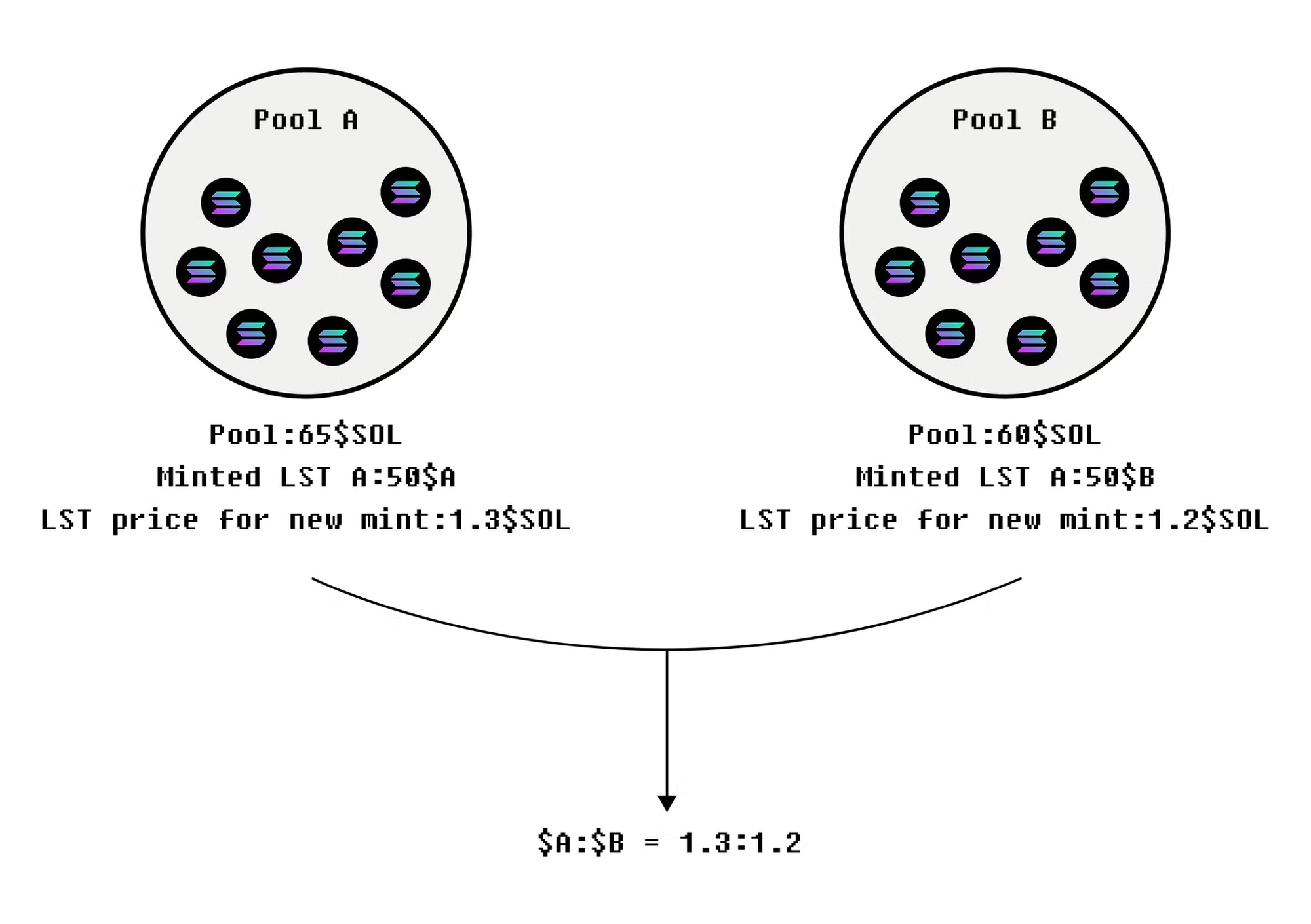

LST in Solana : Sanctum

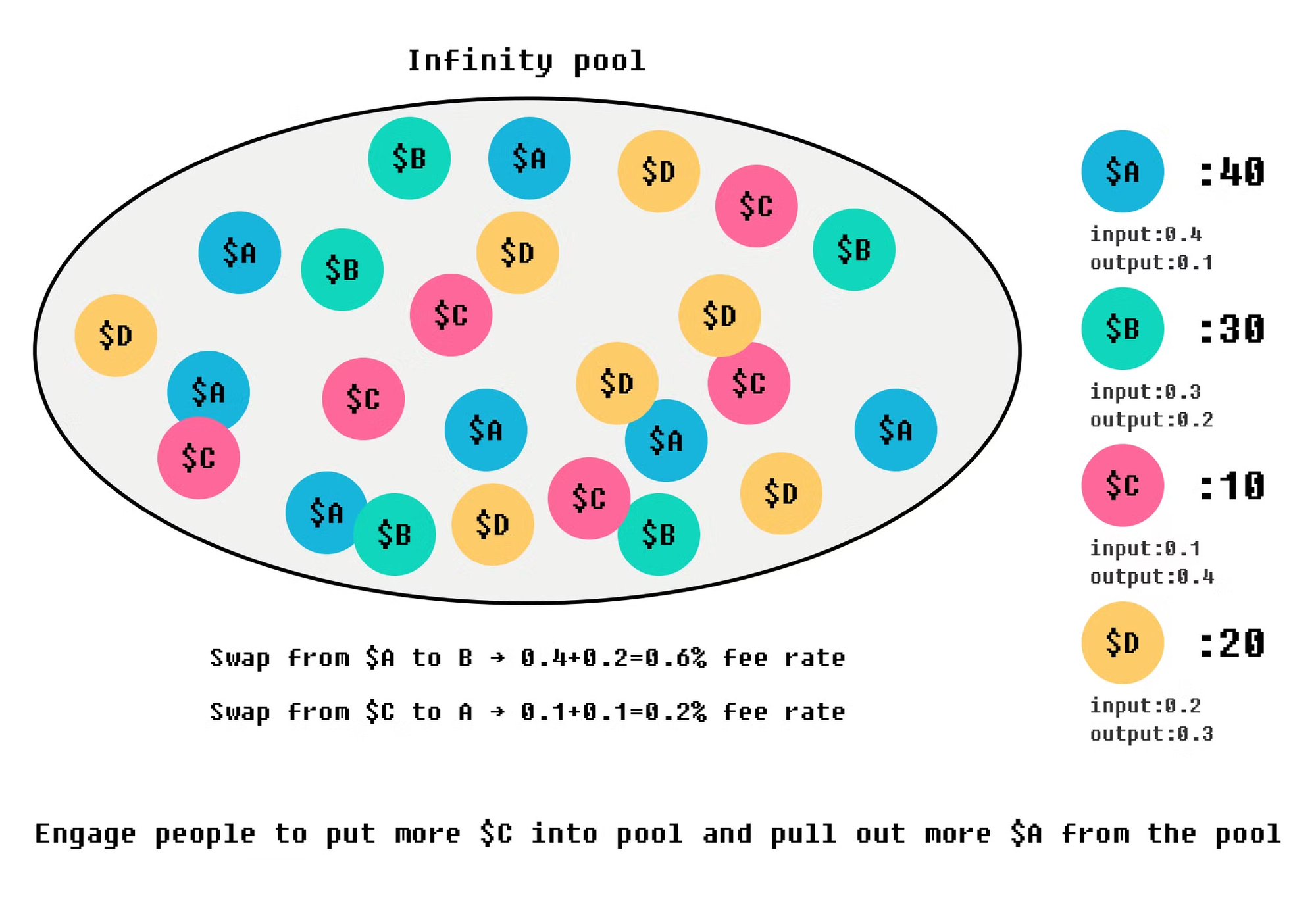

Sanctum has been a pioneer of innovation in the Solana LST ecosystem. Sanctum's Infinity Pool addresses the existing issue with LSTs, which is making them liquid rather than creating new ones. When asked who makes LSTs, the typical response is that anyone can, but the liquidity issue hinders anyone from bringing them into the network. While $SOL is recognized throughout the Solana network, LSTs, such as $jitoSOL or $mSOL, are unique tokens with values exclusive to their creator. Even their addresses are different. Use of LSTs rely on liquidity to maintain their value, but unlike other tokens, the staked Sol serves as the underlying asset. Can we supply liquidity using $SOL and swap LSTs with other LSTs indefinitely? The Infinity Pool, which may be accessed through the Sanctum, makes this feasible.

Unlike traditional liquidity pools, which typically support only two assets, such as USDC-SOL, Infinity is a multi-LST liquidity pool. With this incredible power—the ability to have native support for any number of LSTs in the Solana ecosystem—Infinity supports any whitelisted LST, including bSOL, bonkSOL, cgntSOL, compassSOL, driftSOL, and more. The pool determines the fair price of each LST based on the staked underlying SOL in each account. Instead of relying on traditional multiplication or stable-swap invariance approaches, we can easily switch between LSTs.

For the cheapest shop on any LST, use an on-chain oracle. For example, the price of BlazeStake (bSOL) is computed by dividing its total imports (the amount staked) by the total supply of pool tokens (LST). In any case, we determine this ratio as the lowest price at which we can mint the LST by balancing the staking incentives that accumulate at each epoch. As a result, the SOL value controls all LST pricing, allowing the Infinity platform to precisely enable swaps between any pair of LSTs without requiring complex mathematical models.

Most DEXs have fixed-rate fees, however Infinity has a dynamic price structure. For example, Infinity calculates the total fee for any swaps a user executes with bSOL, including scnSOL, by adding the input and output fees for the two relevant assets. This means that a pool rebalances itself—that is, a dynamic fee structure stimulates or discourages a specific swap—by capturing fees for the pool in this manner. The pool managers may adjust pricing to reduce the cost of SCN-to-BSOL swaps while increasing BSOL-to-SCN swaps. For example, suppose the pool is imbalanced, with an overabundance of SCN and a lack of BSOL. This will urge people to help bring the pool back into equilibrium.

Liquidity from Infinity facilitates the expansion of these more contemporary LSTs. Producing an infinite amount of LSTs assures that the pool has the necessary degree of liquidity, increasing security and removing any barriers for validators to issue LSTs. For example, validators may issue the Validator Liquid Staking Token (VLST). It is 100% portable and applies to all DeFi applications in the Solana ecosystem. This feature increases security because it allows several validators to construct their own LSTs in the same way. This component promotes decentralization, which increases user involvement. To boost user motivation, validators can create loyalty programs that offer airdrop incentives, or NFTs, to the corresponding VLST holders. Users now have access to more LST alternatives, resulting in a more expansive environment for all.

Sanctum has long been a part of the Solana Stake Ecosystem. Along with the Solana Foundation, the team was among the first to contribute to the formal Stake Pool Program, which eventually led to the launch of Socean Stake in September 2021. Sanctum v0 is free of risk. It followed, providing users with a mechanism to convert staked SOL into liquid SOL with less slippage—even if they hadn't provided the token to the validator in the first place. Users can also use this service to transfer their stake accounts to Sanctum for a small fees.

However, Sanctum's importance goes beyond simply providing an additional ways for receiving liquid SOL. They and the rest of the team want to make Sanctum a critical liquidity layer in the Solana ecosystem, allowing billions of Sol stakes to be unlocked within DeFi. To summarize, Sanctum is establishing itself as a critical component of the infrastructure required to properly utilize staked Sol in the DeFi sector. By establishing Infinity, the significant liquidity issue that new LSTs face will be alleviated, laying the framework for a more dynamic and adaptable staking ecosystem on Solana. This innovation allows additional validators and projects to join the network with confidence by ensuring that their LSTs have the liquidity to succeed, thereby strengthening and decentralizing Solana's financial ecosystem.

LST in Solana : Sanctum LSTs

- Infinity (INF) : Sanctum's flagship product, Infinity, is the first infinite liquid staking token pool. It produces an optimized mix of staking returns and trading fees, diversifying a basket of liquid staking tokens. Infinity is an extremely adaptable middleman, making interchangeability between two different LSTs seamless. Infinity has thus invented a myriad ways of empowering users with a dynamic yield-generating platform to enhance liquidity and efficiency in the LST ecosystem.

- aeroSOL : AeroSol is a stakeholder pool that energizes and empowers the Solana ecosystem by supporting contributors from different sectors. Acting with respect, the pool rewards and recognizes those who have made tremendous impacts while giving back what is needed to continue contributing. By delegating stakes to demonstrable contributors toward the growth of the validator network, AeroSOL attracts new developers. Aero's mission is twofold: to support existing teams and contributors, as well as to attract new talent to strengthen the Solana ecosystem.

- apySOL : ApySOL offers an exceptionally high APY of over 10%. The team has recently moved from Ethereum to Solana. ApySOL actively promotes staking within the Solana network, offering a 0% validator and MEV commission. The initiative is targeting exponential growth in its staking services while motivating many other participants who may want to make high returns. With staking commissions eliminated, apySOL enhances the maximum staking rewards and stands out as the best choice for stakeholders seeking substantial yields in the Solana environment.

- bonkSOL : BonkSOL is the first-ever LST that is tied to the BONK validator, providing BONK tokens to its holders. Rewards accrued by the validator—validators give a percentage of block rewards back to people staking via validators—decrease the BONK supply, making it a deflationary mechanism. Airdrops with BONK tokens are given to those holders of BonkSOL above 1 BONK and 0.01 BONK as a reward. And as bonkSOL becomes more integrated into the ecosystem, users can experience engaging and immersive ways to participate in the Solana network by tapping into the benefits brought by the BONK rewards.

- burnSol : BurnSOL is an LST powered by Sanctum, which paves the way for projects in the Solana ecosystem to burn SPL tokens systematically. In turn, the yield is applied to support such initiatives according to the community's vote through BurnDAO. BurnSOL, which is fully deployable to the Heilus Validator without charge, allows for net burning. In addition, there are "fireballs," which gamify the act of burning to some extent. BurnSOL not only contributes to the ecosystem, but it also engages and fulfills the needs of its holders in an interactive manner.

- camaoSol : CamaoSol is an LST set up to provide resonating performance and purposeful decentralization to the Japanese community. It is backed by a data center in Tokyo, which has been supporting Japanese validators since 2021. Among our unique benefits are NFT airdrops, leveraging MEV, commissions, and block rewards. It was designed to expand the Japanese segment of the Solana network, providing a more localized solution for Japanese validators and stakeholders.

- compassSol : CompassSol offers a boosted yield, combining staking rewards, MEV tips, priority fees, and power from high-performance liquidity pools. Because of its decentralized nature, this data center is located in Madrid, Spain, and therefore does not follow the model of common staking hotspots. Its validator is backing an active community member from September 2021, contributing to powering one of Solana's most visited websites. This ensures that CompassSol will perform strongly, serving as valuable public goods for the Solana ecosystem.

- dainSOL : dainSol is the LST of the decentralized autonomous infrastructure network, engineered to secure organizations and agents living in this ecosystem. Holders of dainSOL participate in DAIN's offerings and integrations with Solana services. This LST allows users to increase their presence in the DAIN ecosystem by unlocking exclusive deals and getting early access to DAIN products.Backed by the DAIN core team validator, dainSOL can definitely aid organizations looking to enhance their operations in the decentralized space.

- digitalSol : digitalSOL maximizes Solana's return and ensures zero fees, as well as superior yields and innovative staking solutions. Maintenance commission: 0%. The LST enhances returns because it captures additional MEV and blocks rewards. Innovation features present fresh prospects, including the ability to profit from Web3 storage rewards. This LST is suitable for users who want to maximize their stake while leading Solana network innovation.

- digitSol : digitSol is a high-performance LST that guarantees above-average MEV returns and distributes voting rewards to provide stakers with a high APY. The LST will be operated by a validator and supported by developers on the South American continent, providing geographical diversity and further securing the Solana network. With some of the returns that MEV brings in and voting rewards reinvested back into the community, digitSol will stand as much more than a tool to increase yield: it will act as an amplifier that would otherwise grow the Solana developer community in the region.

- dlgtSOL : The dlgtSOL is an LST that provides high APY through a combination of staking yields, MEV, and SWQoS revenue sharing. With the dlgtSOL, users are essentially contributing to the growth of the Solana Validator Network while benefiting from the diversified stream generated by a hurdle. The redistribution is intended to support validators and the entire Solana ecosystem with stakeholder revenues. The approach ensures maximum returns from each individual while improving the network's overall stability and performance.

- dSOL : dSOL, a yield-bearing LST on Solana, directly supports the Drift Community, the world's largest open-source derivatives decentralized exchange. When staked with dSOL, one will be rewarded for native staking yields, which will in turn increase transaction speeds during trading on Drift. Furthermore, dSOL holders are able to participate in the Drift Fuel Program for active participants within the Drift ecosystem.The program does everything from earning FUEL to unlocking the activity boosters; thus, dSOL is actually a strategic asset for traders and drift enthusiasts alike.

- dualSOL : DualSOL is an LST designed to advocate for the growth of on-chain options within the Solana ecosystem. Every time SOL is staked with dualSOL, users will be rewarded with token options that are subsequently locked up for special access to loyalty options. This LST design encourages better token incentive structures and provides participants with a way to earn or utilize options as part of their staking rewards. By focusing on only on-chain options, dualSOL will present an offering never before available to those looking to increase their participation in the Solana options market.

- eonSOL : Solana holders can maximize earnings with EONpool. Based on 0% cost validator service, it offers staking and MEV incentives. LST holders of eonSOL will receive additional benefits on top of SOL and MEV profits. EONpool's enterprise-grade hardware and specialists ensure secure, dependable, and high-performance validation. This makes it the best option for individuals who want to earn more SOL and MEV tips without hosting a validator node. The service, along with Solana Compass and Stakewiz, gives Solana network stakers flexibility and profit.

- fpSOL : The fpSOL is an experimental LST that serves as the world's first personal liquid staking token. Holding at least one fpSOL grants access to a private Discord channel in which all staking proceeds go toward a charitable cause to be determined by the community of holders. It's an innovation that lets stakers be part of something genuinely community-driven, way beyond classic staking rewards, with fpSOL leading by example in how personal and social elements can combine in blockchain finance.

- fuseSOL : fuseSOL functions as the LST for the Fuse Smart Wallet, providing its stakeholders with exclusive in-app powers and sophisticated platform features. Staked by the Squads Validator, fuseSOL offers extra DeFi opportunities and anti-inflationary staking rewards to holders. As Fuse further develops, it will give more bonuses to stakers, thus making fuseSOL appealing to them in their quest to get the best out of the Fuse smart wallet and the DeFi landscape on Solana.

- gS : An LST guardian validator, is specifically designed for maximum yields, utilizing MEV, commission, and block rewards to facilitate next-level returns for its holders. Holders of gS have distinguished benefits, including one-time minting of NFTs and sharing in validator rewards. Additionally, 5% of block rewards are given towards generating support for the Solana ecosystem; thus, staking with GS implies a return to the individual staker but tickles down to an ecosystem fostering growth and sustainability.

- haSOL : haSOL is the high-yield LST designed by Hanabi Validator to enable users to gain enhanced returns via bribe compounding and increased access to new services and APIs. The added value HaSOL is going to offer has to do with the compounding of bribes, therefore raising the general yield for stakers. Furthermore, haSOL holders will gain early access to Hanabi's services; therefore, the available package has a simply irresistible offer that would be very impossible to refuse for any SOL staker excited by the opportunity of maximizing rewards and access to new developments earlier than the broader Solana community.

- HausSOL : HausSOL is the LST of StakeHaus, one of the highest-performing Solana validator pools known for consistently high yields with zero fees on base rewards, or MEV. The three-month launch promotion includes additional incentives with hausSOL: free DRiP droplets per hausSOL held and chances at a rare or legendary drop. Users can participate in these promotions by purchasing hausSOL with a connected wallet and receiving some of the most competitive yields available within Solana's staking landscape, thus making hausSOL shares one of the most compelling choices for stakers.

- hSOL : hSOL is designed for elite users seeking the highest native yields possible with a validator while simultaneously enhancing network performance. Helius, which sustains itself by selling RPCs to developers, powers hSOL, ensuring that the maximum yield remains unchanged with no fees. The validator's operations contribute to the larger Solana ecosystem by helping developers build faster apps. hSOL is the best call for any staker looking to maximize staking rewards, given their role in improving the network's performance and security.

- hubSOL : HubSOL is the LST connected to the SolanaHub validator, providing an all-in-one solution for everyday utility within the Solana ecosystem. Staking focuses on composable safety, inviting users to discover a wider-area network in Solana. Its stakeholders participate in weekly airdrops from the Loyalty League, designed to reward continuous support and engagement. Holders also contribute a 10% "boost" to their HubSOL holdings in the Loyalty League. With more premium features in its future pipeline, hubSOL positions itself as a one-stop-shop staking solution deeply integrated with the Solana ecosystem.

- IceSOL : Cubik maintains iceSOL, a special LST that indirectly targets the funding required for public goods within the Solana environment. Therefore, by holding iceSOL, stakeholders contribute to the growth and maintenance of public goods, with all proceeds going towards the Cubik grant rounds. In this regard, this LST specifically makes sense for those who want to support the Solana ecosystem in terms of development and sustainability and to be engaged in staking in the process. IceSOL combines financial incentives with community-focused outcomes, making it socially impactful for stakeholders.

- jucySOL : jucySOL offers Solana's highest yield, directly disbursing 50% of all block rewards and priority fees into our users' wallets every epoch. Apart from the usual staking and MEV yields, JucySOL also offers one-off yield opportunities, including the ability to earn BSKT for a limited time. LST is hosted by a leading community validator, so you will not need to worry about decentralization and reliability. Showing strong consideration for decentralization in its structure between the two hubs of Dallas and Miami, jucySOL has placed itself as quite an attractive option for stakeholders aiming for high returns while considering community-driven values.

- jupSOL : jupSOL is a liquid-staked token for the SOL staked to Jupiter's 0% fee validator, which enables transactions on the Jupiter Exchange. This liquid-staked token provides an extremely high APY to bootstrap this validator, making it an excellent choice for users looking to maximize their staking returns while supporting the Solana ecosystem's core infrastructure.JupSOL, a team-managed professional project, offers couple-efficient aspects and financial incentives that appeal to both traders and long-term stakeholders.

- kumaSOL : KumaSOL is the LST that leverages the Solana Foundation's Program of Delegation to further benefit its holders. It's commission-free: 100% of the rewards go back to stakers; extras from stakes not being LST give additional bonus benefits, making maximum returns for kumaSOL holders while contributing back to the overall health and decentralization of the Solana network. Due to the strategic way of delegation and maximum focus on stakeholder benefits, KumaSOL must be quite sound in its approach for those who wish to optimize returns from their stakes.

- LanternSOL : LanternSOL is an LST that "lights the way" in the Solana ecosystem and is backed by a trusted validator who has yielded support to Solana since its time in the testnet. This LST has a higher APY, a lower commission, and reliable uptime, making it dependable for stakeholders. It is managed by experienced hands from its origin in the test net, ensuring stakeholder rewards over time for their trust. Future rewards will be determined, but the potential foundation for lanternSOL makes it a very secure and promising option for long-term staking.

- lifSOL : lifSOL, the LST linked to Lifinity's validator, offers stakers the opportunity to earn rewards while supporting one of Solana's original protocols. Lifinity has made its mark by seeking to enhance Solana's liquidity; therefore, by staking with lifSOL, users contribute to this vital infrastructure while earning native staking rewards. It best suits those aiming at aligning their staking activities with a well-set protocol, which plays the most crucial role in enhancing liquidity and the overall functionality of the Solana ecosystem.

- lotusSOL : LotusSOL is an LST specifically designed for the Lotus community, aiming to enhance its users' understanding of the Solana network. By using lotusSOL for staking, holders ensure maximum rewards while simultaneously contributing to the development of tools and content that enhance the community's understanding of Solana. It hopes to fund initiatives that squash the mystery around Solana, in turn democratizing access to blockchain technology. LotusSOL is perfect for those who value high yields and the advancement of educational resources within the Solana ecosystem.

- mallowSOL : MallowSOL is the LST developed specifically for art creators and collectors, and it is available on the Solana platform. Users holding mallowSOL receive empowerment in points whenever the person buys or sells on the mallow platform for extra perks. In addition, as indicated, holders of mallowSOL earn SMORES that further add value for staking activities. Since it gives financial rewards and allows engagement with the creative community, this is best for those deeply involved in both the art and NFT spaces of Solana.

- MangoSOL : MangoSOL is the LST erected on the Mango Markets platform and offers users a few unique benefits, including elevated collusion contributions and the possibility of DAO-governed LSTs. Staking with mangoSOL grants its users the opportunity to operate a complete suite of finance activities within the mango ecosystem, ranging from borrowing to trading. This LST provides tools for maximum returns for those staying active in DeFi while also engaging with one of the most energetic financial communities on Solana.

- nordSOL : NordSOL is a no-fuss, high-yield LST that seeks to deliver consistent returns through high uptime and extra rewards from block and MEV sharing. Stakers receive returns from both traditional staking yields and the potential for an airdrop once the NORD token is launched. With the Nordic Staking Validator's built-in performance, NordSOL ensures reliable performance with additional perks, making it a solid choice for those looking for simplicity and high returns in their staking strategy.

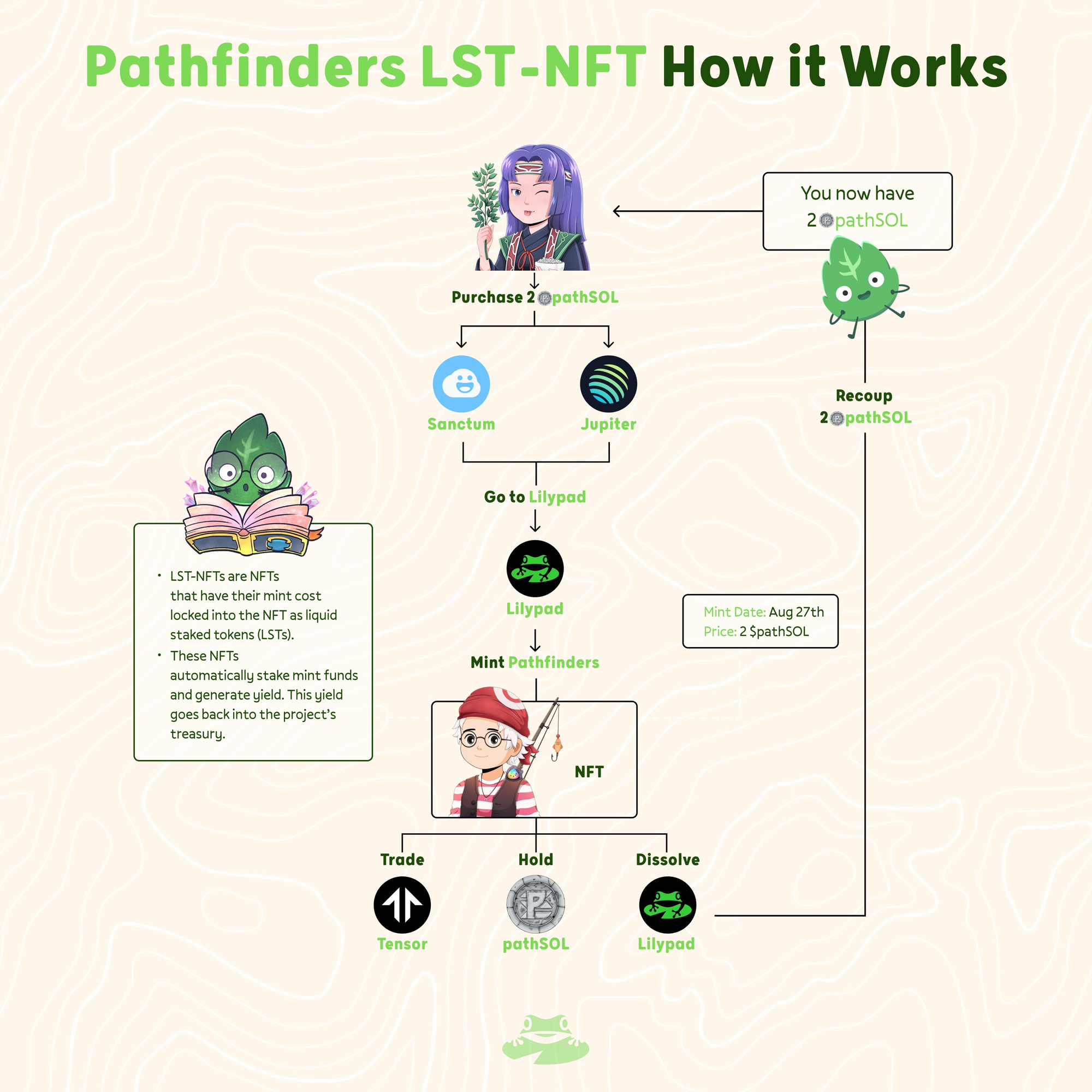

- pathSOL : PathSOL was created so that only the Pathfinders community can have a say in new innovative NFT projects, such as the world's first unruggable NFT. Staking with PathSOL encourages a team to work hard to make NFTs more fair, less risky, and frankly better. In addition, PathSOL provides funding for new types of NFT-based projects within Sanctum, such as Ghibli-inspired intellectual properties. This LST is a godsend for anyone who is into NFTs and wants to join a community of like-minded individuals striving to improve the Solana NFT space.

- phaseSOL : Phase Labs is the platform to forge a bright future in Web3, and phaseSOL is the LST that enables users to harvest rewards in the form of reputation points on the Align Leaderboard. This enhances influence within favorite organizations. In addition to this, PhaseSOL offers staking yields, MEV yields, SOL airdrops with 50% of block rewards, and priority fee kickbacks.Moreover, phaseSOL decentralizes by being the only independent validator based in Mexico, but it also delegates stakes to other ecosystem validators, hence forming a part that is very important in terms of diversification on the Solana network.

- picoSOL : PicoSOL is operated by a former atomic arbitrage bot operator, so he knows a thing or two about running Solana nodes. This LST features a zero-commission structure, kicking back all MEV returns to stakeholders. Holders also receive airdrops to the LST pool as part of their block rewards. Decentralization principles advocate for some degree of geographic decentralization. In that case, picoSOL is operated out of Japan, contributing to the geographic decentralization of Solana's validator network. This makes PicoSOL a rather attractive choice among stakeholders who would like to see recent decentralization and maximize returns through efficient validator operations.

- pineSOL : PineSOL, a LST based on Pine Analytics, is specifically designed to support on-chain analytics and research. If users own pineSOL, then they would have a say in deciding what research is conducted by making sure that the important topics are reviewed and documented. Stakers also fund the creation of on-chain research articles and dashboards to develop a more informed understanding of Solana's ecosystem.PineSOL is the best option for those looking to support data-driven research and be able to stipulate what kind of analytics are most beneficial for Solana's community.

- polarSOL : PolarSOL is an LST from the Polarbear independent validator, aiming to maximize staker rewards through reward sharing. It aligns with the small individual validators to try and decentralize the Solana network by maximizing staker returns. At its heart, it suits very well someone who would like to delegate to smaller validators but still wants to maintain competitive returns for staking. PolarSOL's emphasis on decentralization and community support makes this LST a valuable addition to any staking portfolio.

- pumpkinSOL : PumpkinSOL is a high-performance LST operated by Pumpkin's Pool, which is a validator committed to the lowest possible fees, community involvement, and facilitating Solana development. Notably, a multi-validator failover system ensures that stakers get the same reward with very high uptime. Above all, it adds extra MEV rewards exclusively for PumpkinSOL holders. In addition, the company donates 5% of its profits every month to any organization that helps animals. This makes PumpkinSOL a worthwhile option for those seeking to combine return on investment with social good.

- pwrSOL : PwrSOL is the LST in concert with The Lode Validator, a venture capital firm from Lode Ventures known for their Sentries NFT project. Powered by 0xNallok, a seasoned veteran of cryptocurrencies and a JITO delegate, pwrSOL receives outstanding yields and state-of-the-art technology. This LST empowers MEV to achieve better returns and focuses intensely on being at the forefront of new quality standards for new projects or Solana protocols. PwrSOL is the ideal solution for stakeholders seeking a high-performance validator with close ties to the most innovative projects within the recently established Solana ecosystem.

- rkSOL : rkSOL is an LST related to the StaRKe Solana Validator, a very high-performance, integrity-, reliability-, security-, and passion-driven validator. With its no-fee approach, this validator returns all stakeholder rewards to stakeholders, making it efficient for maximizing returns. The no-fee strategy at rkSOL enables community contributions to the Solana network; hence, its believability is boosted. This LST is ideal for stakers who want to prioritize security and reliability in their staking activities while still considering the health of the Solana ecosystem.

- rSOL : rSOL is designed to be a multiyield-bearing LST that empowers its natively decentralized DeFi ecosystem. With rSOL staking, supporters get rewarded with pre-decentralized bonds and take on extra APY restaking through the Reflect IFund. It will ensure that all yields from the Reflect Validator are returned to supporters so that stakeholders can find their full benefits. rSOL is a product designed for active DeFi users of the Solana chain who want to maximize their returns while also helping to fuel the Reflect Protocol's growth and development.

- spikySOL : Hedgehog Markets introduces SpikySOL, an LST designed to incentivize holders with bonuses from Hedgehog and encourage contributions to the Solana community. With SpicySOL, staking is a support function for community and open-source initiatives, which is very helpful for people who want to support the larger ecosystem. SpicySOL's richer integrations within the Solana network make it a very powerful tool for enriching the ecosystem. This LST is ideal for users who want to earn a financial return on their contributions to social, community-driven, and open-source development in a meaningful way.

- stakeSOL : Stake City citizens will be holding stakeSOL to earn double points in spinning for NFT prizes in the Stake City arena. StakeSOL is exclusive to LST for Stake City citizens, offering unique rewards to its participating community, nudging them ever closer to being an active part of the Stake City community and gamified reward citizen system.StakeSOL aims to enhance community engagement by providing tangible benefits, thereby appealing to both community-oriented users and those who prioritize value for their money.

- stepSOL : StepSOL, a collective LST involving the communities of Step Finance, SolanaFloor, and Solana Allstars, has partnered with the Worldwide Web Foundation to reinvest 100% of all revenue in STEs. This is achieved by purchasing STEs from the market and providing them to xSTEP stakers as an emission-free yield. StepSOL is also optimized to exhibit geographically decentralized qualities in order to work in less-used data centers. Additionally, stepSOL holders are entitled to Step Reward Options, which can be claimed on the Step Dashboard every five days. This LST is ideal for those involved in the Step ecosystem who want to maximize their staking rewards while supporting Solana's growth initiatives.

- strongSOL : strongSOL is a liquid staking token powered by a leading Stronghold Validator, uniquely structured to boost your SOL investments. It's part of the Six Nine O initiative, supported by a trusted, high-performing validator, and comes with the exclusive partnership of numerous ecosystem participants. The Stronghold Validator is open to exclusivity and committed to the most advanced solutions and highest quality standards for new projects.StrongSOL presents an exceptional opportunity for the staker community, providing guaranteed returns and a robust ecosystem support system within the Solana network.